The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for August 2022 compared to August 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for August 2022 compared to August 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

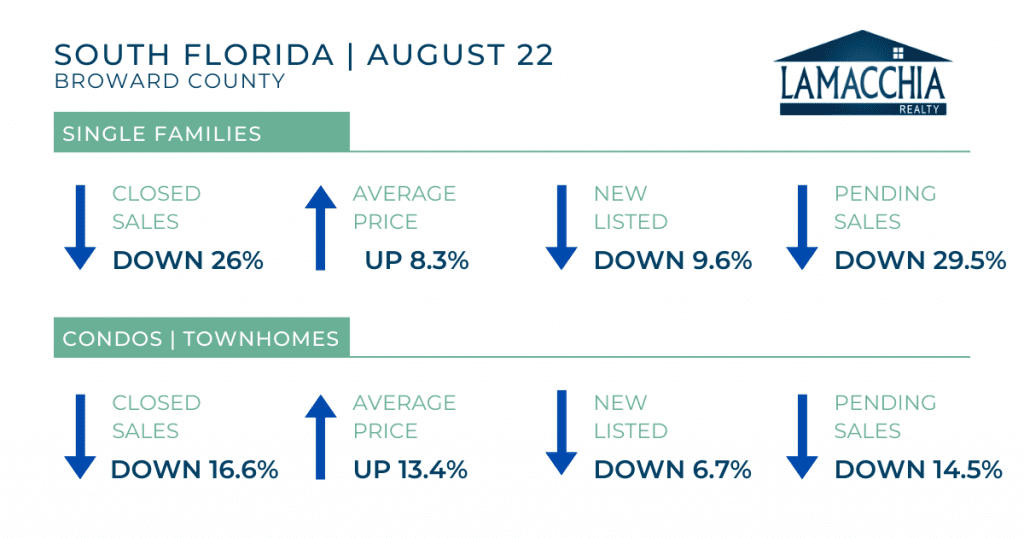

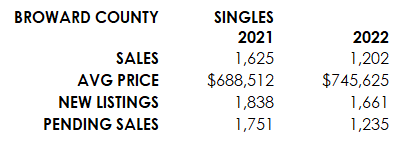

Broward County

Broward County single family and condo/townhome closed sales, new listings, and pending sales decreased. Average price increased in both property types.

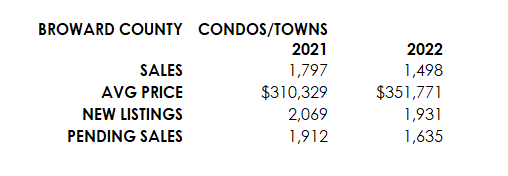

Miami-Dade & Palm Beach Counties

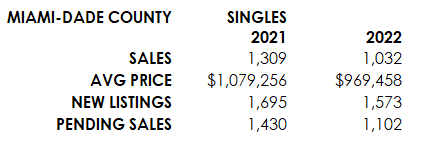

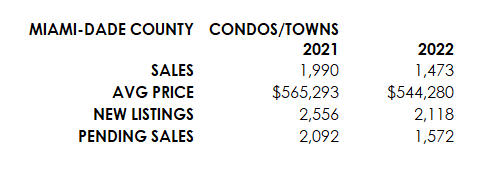

In August of 2022, Miami-Dade single families and condos/townhomes saw decreases in closed sales, average price, new listings, and pending sales.

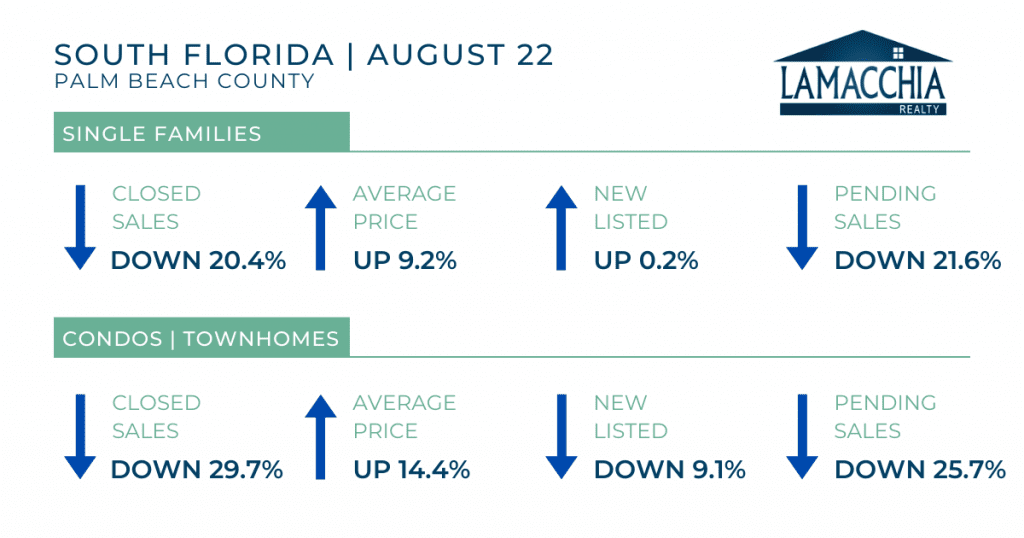

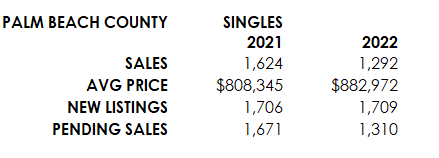

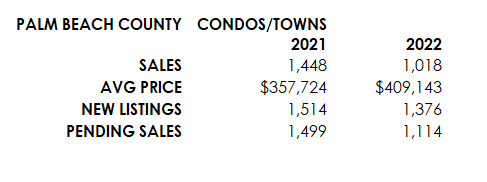

Palm Beach County single families and condos/townhomes saw a decrease in closed sales and pending sales and an increase in average price. However, new listings for single families increased slightly compared to condos/townhomes which saw a decrease in new listings.

Highlights

-

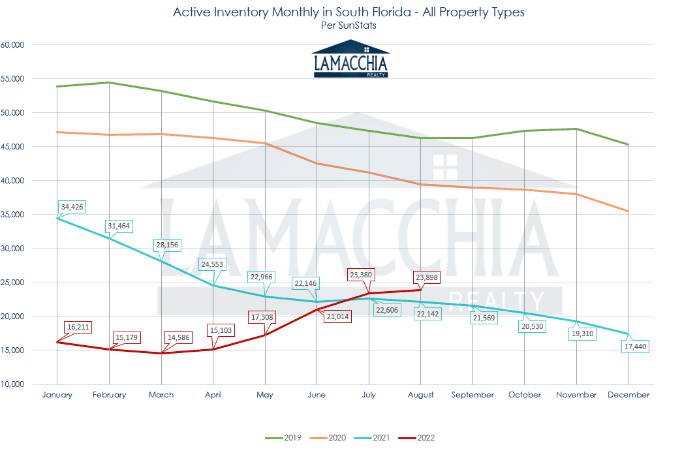

South Florida active inventory levels increased yet again in August. Increased mortgage rates have slowed the market (i.e., less active buyers), therefore, inventory is no longer being cannibalized by frenzied buyers facing extreme competition.

-

This means homes are staying on the market longer which will inherently cause inventory levels to rise and they will likely continue to do so as we head into Fall – especially since mortgage rates are starting to climb again after staying lower and leveled during the summer months. As inventory levels keep increasing (i.e., more supply), home price appreciation is expected to continue to decelerate. Exemplifying this, average prices in August are still up year over year but the rate in which they are rising has slowed significantly, even decreasing for Miami-Dade County single families and condos/townhomes.

-

Given perceived economic uncertainty, sellers are generally more hesitant to list and, accordingly, new listings are down across all counties and categories, except for Palm Beach single-family homes which only saw a 0.2% increase. Although, a slowdown of new listings would contribute to a decrease in inventory levels, South Florida inventory’s saving grace will be that it is a popular market for 2nd homes, and that market is seeing a downward shift in demand.

-

The number of closed sales in August was down across all counties and categories. However, as predicted, the percentage decrease is less when compared to last month where closed sales were significantly lowered due to the initial rate spike in late May. We may see these closed sales numbers decrease again heading into Fall as mortgage rates have come back up and have stayed well over 6% in recent weeks. Pending sales are also down quite a bit again in August 2022 and this is a big indicator that closed sales will also likely be down again in September.

-

Buyers are backing out of sales at a clip not seen since the initial shut down in March 2020. These buyers are pulling out from deals due to rapidly rising rates impacting what they can afford, appraisals coming in too low, and inspections revealing the home needs more work than initially planned on. With supply chain issues and inflation, buying a fixer upper may not be as good of a money saving option as it was before.

-

Buyers, there is a cost to ‘waiting for rates to come down’ and staying out of the market. Diminished buyer affordability means there are fewer buyers in the market, and this lowered demand increases the availability of homes, lessens the extreme competition buyers have been used to seeing in the market and yields a lessening of bidding wars.

-

When mortgage rates spiked, many active buyers decided to rent for another year, therefore, the rental market became quickly saturated, sky rocketing demand for rentals. This has hiked up the cost of renting, making the decision between rent prices vs mortgage prices one worth evaluating even more so than in month’s prior to the rate increase.

-

Sellers are advised not to make the mistake of overpricing your home in this changing market. To stay competitive in this new landscape, being reasonable and realistic is key. Pricing your home right will ensure your home sells quickly and for the most money. Pricing incorrectly will result in your home sitting on market, and you will inevitably have to adjust the price, and you could possibly make less in the end.

-

Additionally, as covid guidelines are lifted, more companies are requiring that employees return to offices to work on-site. Those who moved to South Florida during the pandemic may now have to sell and head back to where their work location is. With less employee mobility, this also means there will be fewer buyers in the South Florida market compared to the early years of the pandemic.

*Data provided by Florida Realtors® SunStats