There is nothing wrong with that house!

The Fall of 2022 looks different than the past few years with mortgage rates higher than they’ve been in years, prices still high, and inventory, which has been at historical lows since the summer of 2020, beginning to increase. Homes are starting to be available on the market for longer than a day or two, a welcome change from the frenzy of the post-COVID market.

Buyers, who have largely been begging for greater selection, now have the habit of thinking that there is something wrong with the house because it hasn’t gone under agreement in record time. This phenomenon happens often in the fall when a home sits longer than it would have earlier in the year; buyers find a home they like that’s been listed for a little while, and many will ask “what is wrong with it?” The consumer wants what others want. If a buyer thinks that the home has been passed up by others, maybe there’s something about it that’s wrong and they too should move on.

The absolute truth is NOTHING is wrong with THAT House. The fact that a property has lingered on the market a little longer than earlier in the year rarely has anything to do with the house itself and we are starting to see this happen as we get into the fall. This has been the silver lining of rates rising this year. Buyers finally have selection. Yes, the cost of borrowing is higher for sure. But it’s better to buy now at this price and this rate, then wait, the cost of the home increases AND the rates potentially rise. If rates go down then more buyers will likely come out of the woodwork, multiple offers will arise out of a frenzy, and the price will go up in order to outbid the competition. A new wave of frenzied buyers not only brings about multiple over asking offers, but also waived contingencies and less buyer negotiation power overall. Now is better. And if rates do drop over time, you can refinance to the lower rate to obtain a lower monthly payment. But you can’t refinance your way out of a higher purchase price.

The buyer pool has been reduced at this point of the year due to a portion having already secured homes, some extended their leases and decided to start over next year, and some because what they can afford has been diminished with rising rates. The buyers that remain are generally the most motivated, as active buyers in the holiday months tend to really be dedicated to the search. Many decide to wait until after the holidays, which is not advisable for anyone hoping to get the best price.

Think you will pay less in the spring? Think again.

The proof is right in front of you. All of the homes listed below from MLSPIN were at one point listed before the new year, taken off market, and then relisted again after the new year and they all sold for more in the spring than they would have had they sold initially.

(Click to enlarge, all photos per MLSPIN)

These homes sold for more after the first of the year when the supply was lower and the demand was higher. The majority of these homes were relisted with the same agents and the same pictures so it goes to show it wasn’t about marketing or the agent, it was simply the timing. This timing can and should be taken advantage of by buyers. Imagine being a buyer who hesitated in the fall by thinking “What’s wrong with it” and then paid more in the winter? The crazy part is this happens every single year.

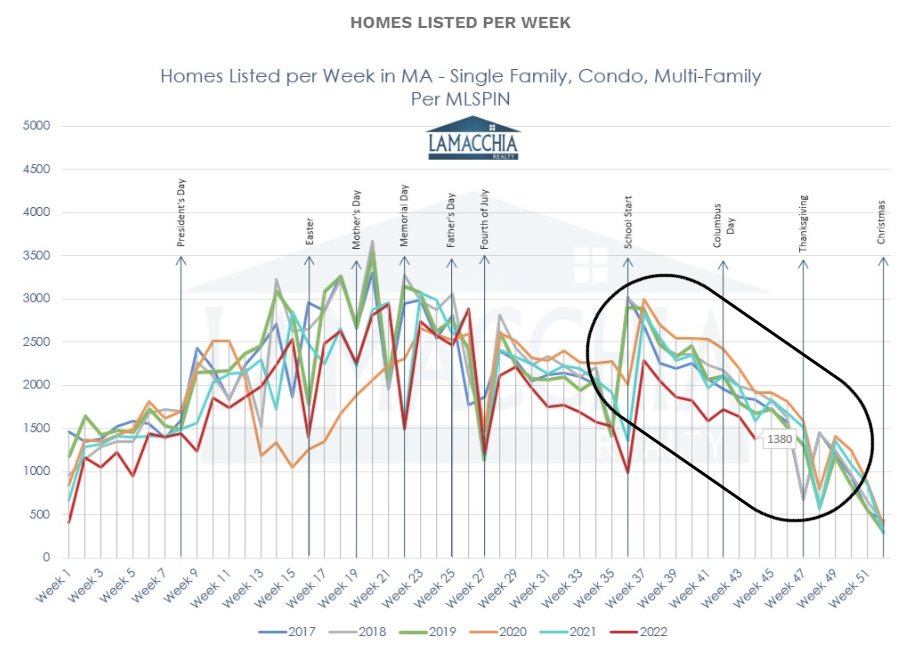

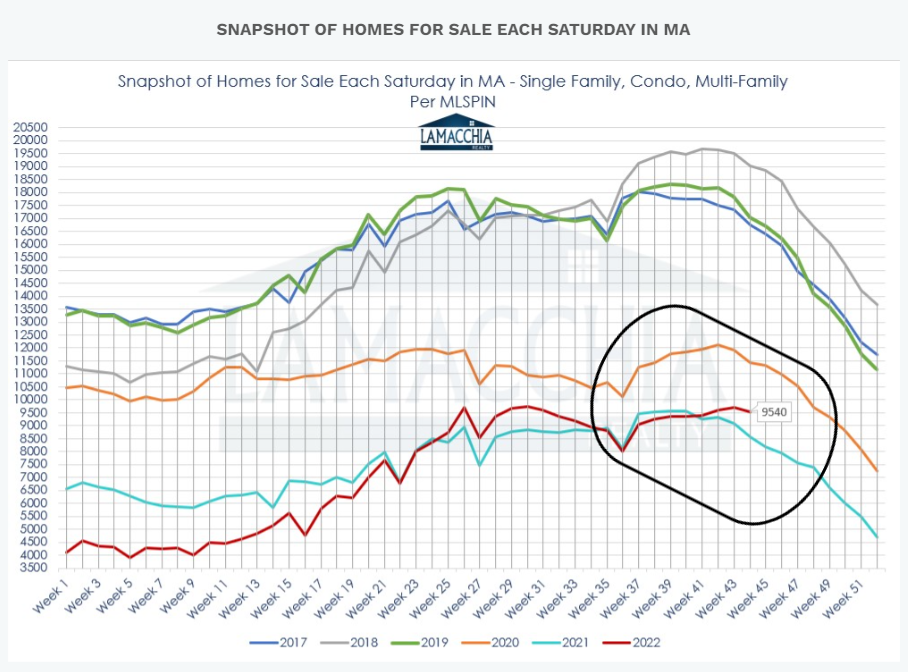

Why does this happen? Why do homes sell for more in the spring? Because there are fewer homes on the market than there are buyers. See below, it starts in the fall as the number of homes listed decreases and it continues thru to spring, and this year in the red line is lower than it has been in previous years. 2023 will likely begin with even fewer homes on the market diminishing supply.

Buyers at the beginning of the year are properly motivated to make the move. It’s the mentality of the New Year’s resolution; the new year, new home mantra. Some of these buyers are new to the market, and some of them are the really motivated ones who didn’t get what they wanted before the holidays. This is the perfect storm for low supply and high demand, and what does that do? Creates a frenzy and we are back to multiple offers and the seller’s market we described earlier.

The bottom line is that if buyers want more selection, more negotiating power, and a good price, the time is now. Sellers who have been on the market may be considering withdrawing once Thanksgiving hits and relisting in a couple of months, or they may be on the market long enough to want to get the deal done and negotiate a price instead of going forward with a price adjustment. See the red line above, where this year there are more homes on the market than there were this time last year (buyers, read: selection).

When do prices peak?

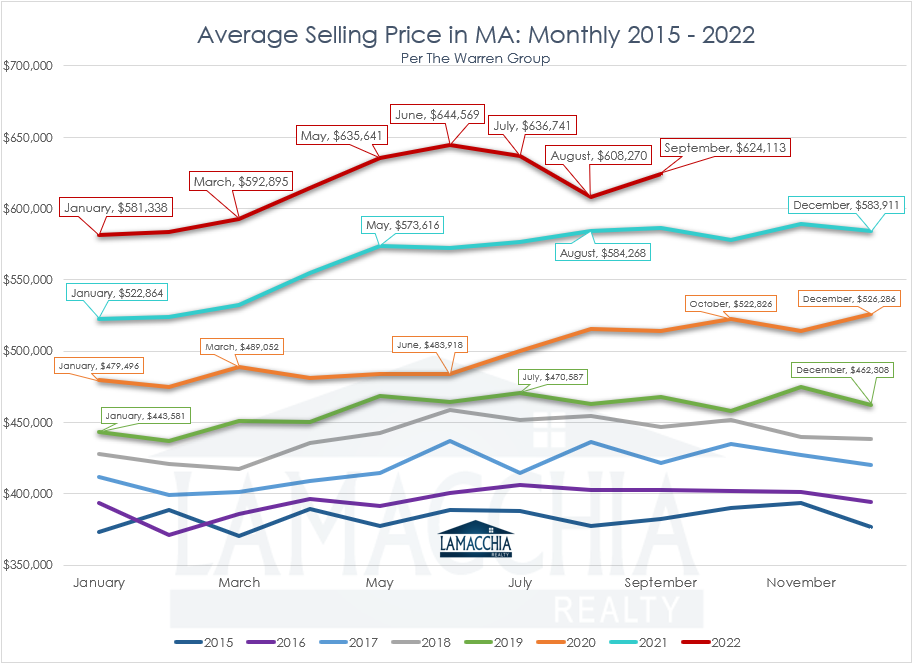

Typically, prices behave in a seasonal manner where they peak in the summer, but as we all know prices have done little aside from rising over the past few years regardless of the season. It’s important to understand though that the average prices we see are prices negotiated sometimes months before as there is a delay between the accepted offer and when the deal closes. Prices are recorded at closing and the sale is done, not when the offer is accepted, and the property goes under agreement.

The homes that sell and close in June and July were negotiated and signed in the late winter or early spring when inventory is low and demand is very high, so they sell for more.

The actual closed sales in January and February are mostly from sales that were negotiated and signed from September through around Thanksgiving when inventory is much higher, and demand is naturally lower. Simply put, when there are more homes for sale, homes sell for less, and when there are fewer homes for sale, homes sell for more. Supply and demand!

This line graph below shows the average sale prices of homes month by month back 8 years and how prices continue to rise from the start of the year:

Why is there more demand in winter and spring?

There are two reasons there is more demand in the winter and spring than in the summer and fall.

Tenants – Many more tenants have leases that expire in the spring than in the fall because landlords know it is far more difficult to rent a unit in the fall than in the spring. Every winter and spring there are thousands of want-to-be-buyers across Massachusetts with the intention of buying a home instead of renewing a lease. Mortgage rates aren’t the only thing increasing- rents are rising too.

New Year – New Year plans really do have an impact. Believe it or not, New Year’s Day is always the biggest single day of the year for logins to search sites like Realtor.com, Zillow.com, Homes.com, etc. This is because many people go through fall planning to “Buy a home next year.” Then as soon as it’s the next year, they start looking and get impatient.

Seasonality – The school year cycle has a big impact on the plans of many and that is understandable. But there are also many who just believe that buying in the spring is best! This data proves that it simply isn’t true.

Follow Warren Buffet’s words of wisdom

As we said at the beginning, more often than not, there is nothing wrong with THAT house that doesn’t sell immediately or has multiple buyers competing for it. It is simply the market timing. As a buyer, you should use that timing to your advantage. The best thing you can do is follow Warren Buffet’s words of wisdom, “Be fearful when others are greedy and be greedy when others are fearful.”