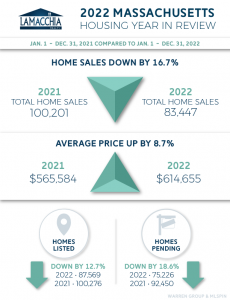

Sales Decline 16.7% in Massachusetts

The 2022 Massachusetts Year in Review Housing Report breaks down average prices, sales, inventory, new active listings, and pending sales for 2022 compared to 2021 and illustrates what that means for the current market.

prices, sales, inventory, new active listings, and pending sales for 2022 compared to 2021 and illustrates what that means for the current market.

2022 was another historic year in a succession of historic years for the real estate industry. 2020 the world was rocked by the breakout of COVID, the second half of 2020 and then 2021 experienced a frenzied housing market with inventory lower than it ever has been in recorded history, and 2022 was the tipping point when the market began its journey back to baseline. Market adjustments, global pandemics, and anemic inventory are not for the faint of heart. To have skin in the game of real estate over the past three years has required dedication and resilience and so we are well prepared for what’s to come as we adjust back into a more balanced market.

Annual sales for the state of Massachusetts were down for the year. This is NOT a sign that the market is crashing in the typical terms that it is understood. Many twists and turns over the past few years have been easily spun as harbingers of doom for the market- headline-grabbing click-bait. But with everything that’s happened, nothing has crashed yet. Yes, sales are down over 16%, but of course, they are. If you look at the fact that they were down every month this year compared to last, that’s the first clue, but if you look at the rapid and unsustainable rise in sales in 2021 it’s no wonder that 2022 was down. And thank goodness it is. This state (nor does this country for that matter on a grander scale) doesn’t have the inventory available to maintain that level of demand.

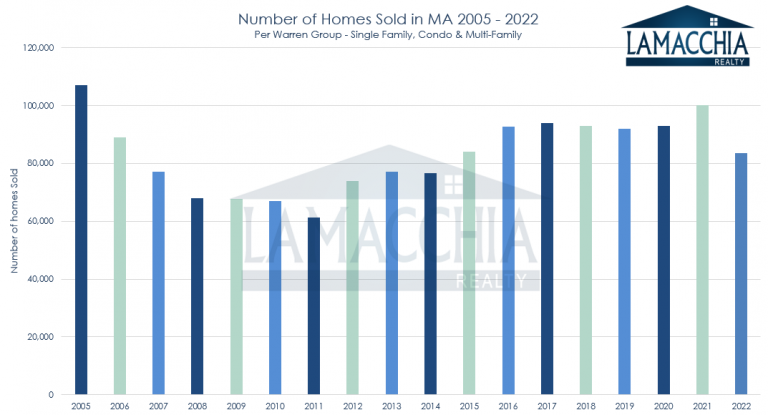

Below is a graph that illustrates home sales per year since 2005. You can see 2021 exhibited an outlying rise in sales, and 2022 exhibited a significant decrease.

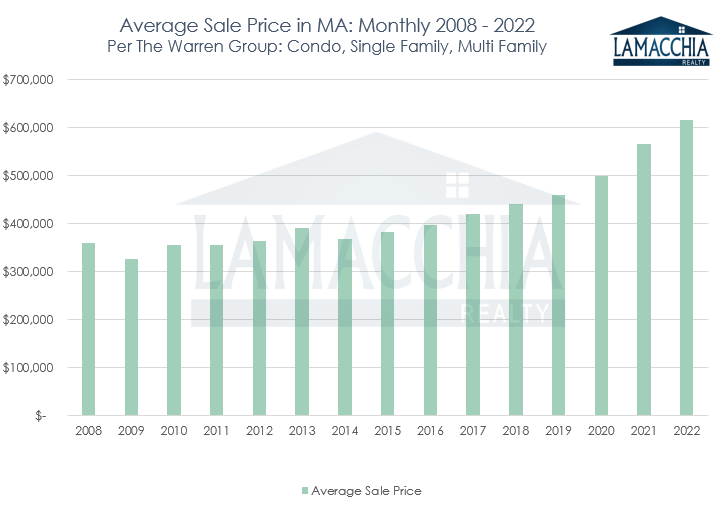

Below is a graph that illustrates monthly home prices since 2015. 2022 average home prices were higher than ever, and even as the market began its adjustment in June and though month-over-month prices went up and down (more click-bait headlines that prices were dropping), year-over-year prices were still significantly higher each month. Therefore, prices for 2022 were up almost 9%. More on that later.

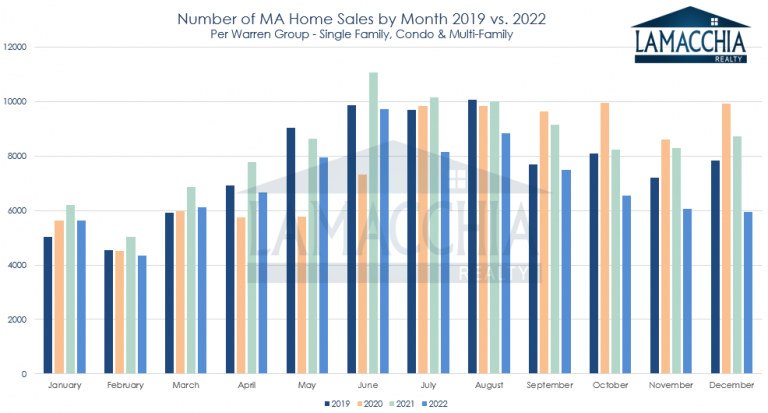

2022 sales were down every month over 2021. In the first three months of the year, sales were similar to 2020 before the start of the pandemic, though it was still a slow winter with all things considered. Spring came and from April to June sales were again, lower than 2021 but much higher than 2020, making up a bit for lost time. Then rising rates happened and sales were down compared to 2021 and 2020 as buyer affordability diminished with each point raised. Remember, at this time prices were still rising so it was a double whammy for buyers and thus the decrease in sales.

Single-family sales fell to 52,236 compared to 62,011, there were 23,181 condo sales in 2022 compared to 28,383, and multi-family sales dropped to 8,030 over 9,807. Overall, there were 83,477 total sales in 2022, 16.7% lower than 2021 which totaled 100,201.

Take a look at the chart below which depicts home sales monthly from 2019 to 2022.

Prices Increased 8.7% in Massachusetts

Average sale prices for 2022 rose to $614,655 from $565,584 last year. Sellers were still able to sell at a premium because inventory was low enough that despite rates, buyers paid what they had to.

Prices for single families increased by 7.93% to $683,819. Condos increased by 12.5% to $485,552 and multi-family prices increased by 6% to $657,332. Overall prices jumped up 8.7% to $614,655.

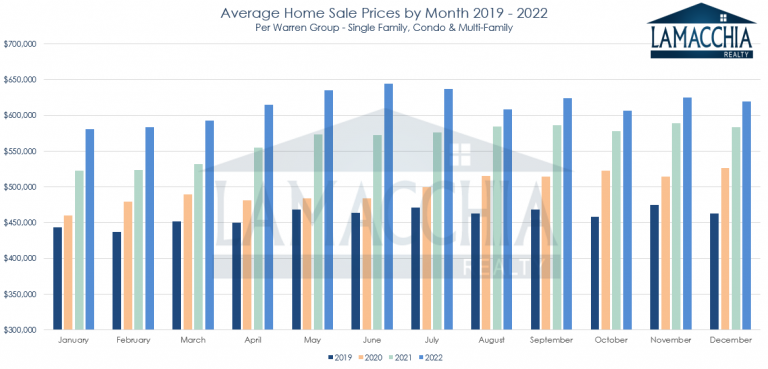

Monthly prices are illustrated in the chart below from 2019 to 2022. You can see that the rate of increase was much larger in the first 7 months of the year before buyers felt the impact of the rate hike. Prices, nonetheless, increased every subsequent month for the entire year.

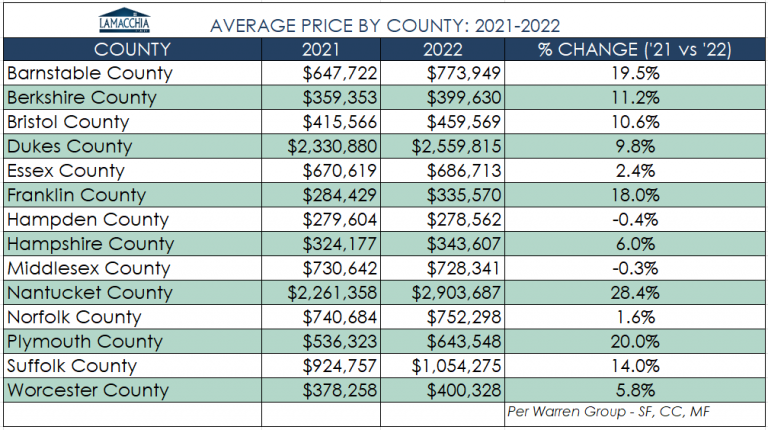

Homes Prices per County

Prices increased in almost every county, and in the counties that technically decreased, the change was negligible, under half a percent. Those small decreases were in Middlesex and Hampden Counties. Prices rose by the highest percentage in Nantucket County, and then in Plymouth and Barnstable counties.

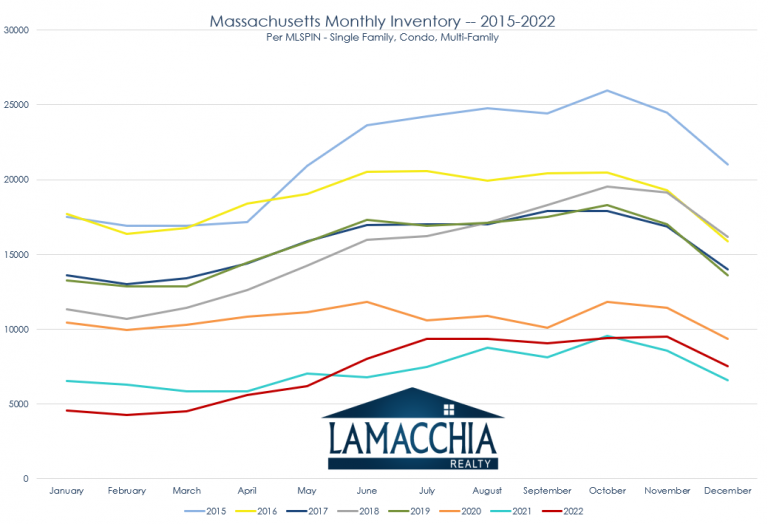

Inventory of Homes for Sale

Inventory started lower this year than in 2021 which was already the lowest on record. It took until mid-May for the line to cross over and for inventory to rise for the first time year over year since the beginning of 2020. The rising rates and prices which diminished buyer affordability took those buyers out of the pool thereby causing fewer homes to sell. Additional inventory in the market is a good thing that has been necessary for well over a year. As inventory rises, the supply and demand tug of war will be a little more balanced and it’ll likely cause prices to decline to more affordable levels in the next year. Anthony explains this welcome trajectory in his predictions for 2023. Falling prices shouldn’t scare people. Real estate is a long game and market adjustments do not last forever.

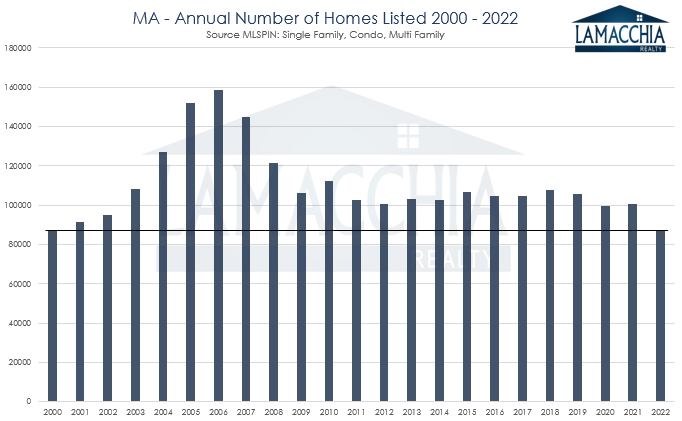

Homes Listed for Sale

In the chart below, you’ll see that 2022 marked the least number of homes listed for sale than any other year since 2000. The year itself started off slow, which is the result of seasonality as most winters start off slow, the first rate hike in April where we saw 5% for the first time in years and buyers held off, and then the subsequent domino effect of rates staying at that level or higher for the rest of the year. Rates don’t just impact buyers- they impact sellers too as most sellers are buyers! If you think the rates are too high for you to afford as a buyer, you’re certainly going to hesitate to list your home which likely has a rate of 2-4%. This is going to be the story for a while until buyers and sellers realize that rates in the 5% range, give or take a point or so, are actually very normal rates!

Buyers and sellers were spoiled by COVID rates being lower than ever, but that was a temporary band-aid applied by the FED to keep the economy, and by extension, the real estate market, going during the pandemic. It was an overcorrection and it’s not going to happen again unless something unforeseeable like a war or a pandemic happens.

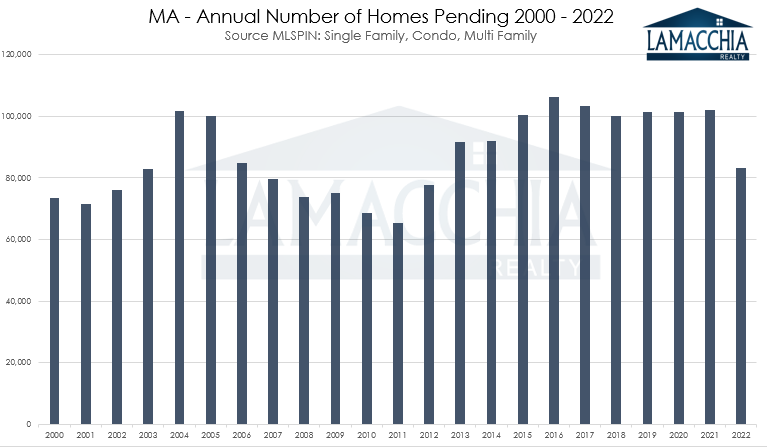

Pending Home Sales (contracts accepted)

In the chart below, you’ll see that the number of homes pending in 2022 was finally lower than year’s past. This is a good thing, again, because there needed to be a revitalization in inventory. Fewer buyers made offers due to sticker shock, it’s as simple as that. But these are key components to the market adjusting to a more balanced state.

2022 and Beyond

In last year’s outlook we said, “according to Anthony’s 2022 Predictions, the entirety of 2022 is going to be a wild ride.” We then provided a few reasons which were that inventory was predicted to stay low, prices were projected to continue their ascent, and mortgage rates were likely to continue to rise. All of that came to fruition, though the extent to which these factors occurred wasn’t predictable at all.

According to Anthony’s 2023 Predictions and our data, 2023 is going to behave with parallels consistent with the 1982 market adjustment in that inflation will run up interest rates, inventory will remain low, and sales will be down. Nonetheless, real estate is an industry in which regardless of the conditions, the show must go on. Real estate is a cyclical machine that is impacted by seasonality, economics, politics, and many more things, but everyone needs somewhere to sleep.

For buyers who have been dying for prices to level out a bit, it’s recommended that this time be taken advantage of, and not taken as a sign that the market is crashing and use it as another reason to wait. Lowered average sale prices are exactly what everyone has been praying for: more affordability and a way to combat the cost of borrowing. Homes taking more than 24 hours to sell is a good thing as well, not a sign that the house has something inherently wrong with it. Buyers finally have a little leverage and negotiating power again, it is wise to know a good thing when it’s seen.

Sellers who are on the fence about selling should know that selling a home with a mortgage of 2-4% might sting but getting a new one at a rate of 5% is not the end of the world and there are ways to get a lower rate a least at first through a mortgage rate buydown program or a mortgage assumption. As mentioned before, rates are likely never going to drop back into the 2’s or 3’s. The need to relocate, increase the number of beds with family growth, find an option with an in-law, or downsize are a few of the potential reasons moving has to happen for people despite the market, and there are ways to get it done successfully and so your home is still your greatest asset. Time to cut your losses and move on if you have to sell. Luckily, there are options to ease the sting, for example, you could enter into a new mortgage with a Buydown so that the first few years’ payments reflect a lower rate to help ease you into a higher rate.

The benefits of homeownership are not outweighed by the cost increasing because, at the end of the day, rents increase as well. First, when you own your own home, whether it’s a condo, single-family, or multi-family you control your own domain. The space is yours to do what you’d like. Secondly, you have a fixed monthly payment, which segues to the third benefit of asset growth. Your monthly payments are what you expect, no one is going to raise it on you and when you pay that bill, you’re paying into your own equity, not the landlord’s. Lastly, mortgage interest is tax deductible, meaning you can write off the interest you pay, which is greater at the beginning of the life of the loan.