This extensive report breaks down average prices, sales, inventory, listings, and pending sales for Broward, Miami Dade, and Palm Beach counties for the 2022 market performance as compared to 2021 and even has data for a few years prior to provide you with a reference point.

2022 was yet another year for the books, as historical market behavior stuck this time with mortgage rate spikes, causing this year to be the adjustment year we all knew was coming. Florida sales aren’t always impacted by rates as cash sales are prevalent, but they impacted the market nonetheless.

Anthony digs deeper into the details of how this adjustment is going to shape 2023 in his 2023 Predictions.

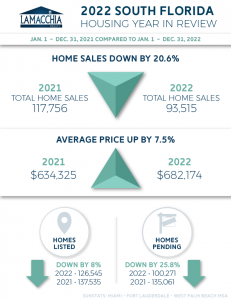

Total Home Sales

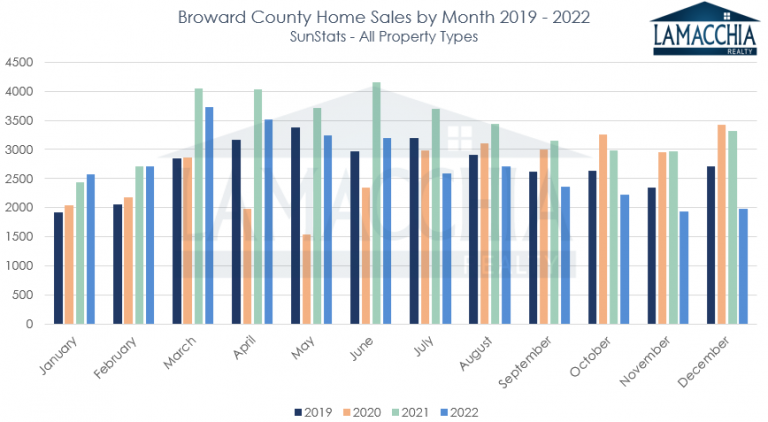

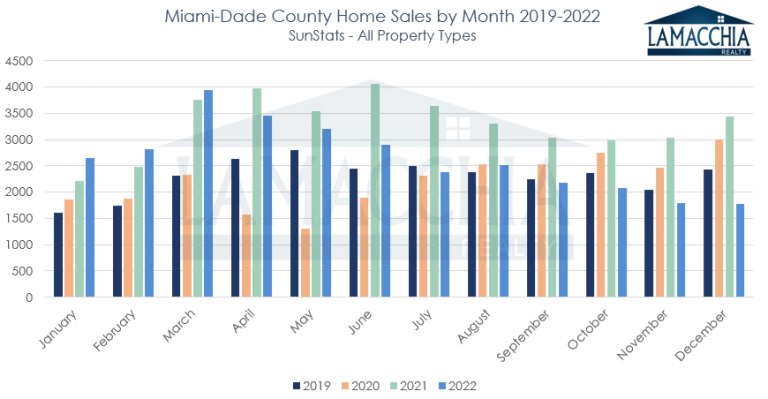

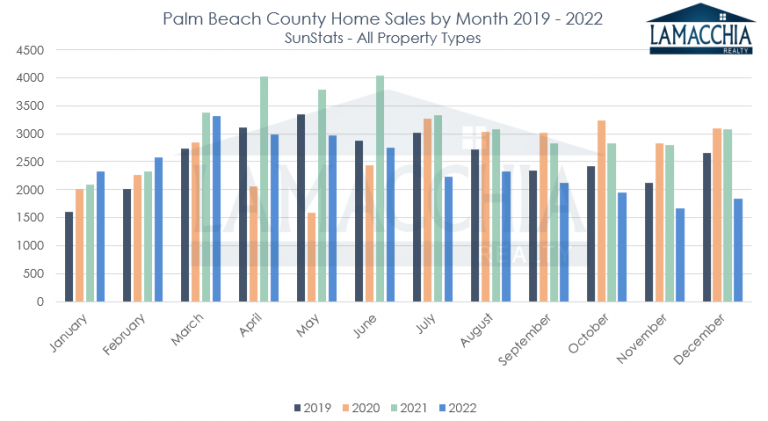

In the charts below you’ll see that from January to March 2022 sales were off to a decent start mostly beating 2021 but from April through the end of the year sales just couldn’t match 2021. It’s not a surprising outcome as 2021 will go down in history as an unbeatable red-hot market. Sunbelt states like Florida experienced even more demand than northern states as many moved to these sunnier states when Covid forced everyone into a ‘work from home’ work environment. That level of demand is what caused prices to skyrocket, and an adjustment year is exactly what the market needs to build up supply.

The charts below show home sales by month for all property types from 2019 to 2022. 2019 is shown to depict the pre-pandemic market

Overall sales in Broward County were down 19% over 2021. Single-family sales declined 22% from 18,565 to 14,438. Condo sales declined 17% in 2022 from 21,858 to 18,135.

Overall sales for the year in Miami-Dade were down by 20%. There were 12,250 single-family sales down by 20% from 15,705, and there were 19,377 condo/townhome sales down 18% from 23,689.

Overall sales for the year in Palm County declined 23% with single families down 23% and condo/townhomes down 24%. There were 15,118 single-family sales compared to 19,495 in 2021 and there were 13,720 condo/townhome sales compared to 17,952 sales in 2021.

All three counties exhibited declines in both categories annually when compared to 2021. Similar to how many moved to South Florida during the height of the pandemic, many of those transplants were forced to move back to the states they came from as many companies reverted back to requiring employees to work on-site. Additionally, many are facing budget constraints with inflation as high as it is which raises the price of consumer goods (ex. gas), and the first expense to come out of people’s budget is their 2nd home expense. The 2022 market in South Florida had to contend with already historically low inventory, the rates spiking in the summer, and then the tragic weather incidents of Hurricanes Ian and Nicole

Prices in All Three Counties

Consistent with national trends prices increased in Broward, Miami-Dade and Palm Beach Counties. The game of supply and demand dictates the direction that prices are going to go, with low supply and high demand prices tend to rise and that’s exactly what happened in 2022.

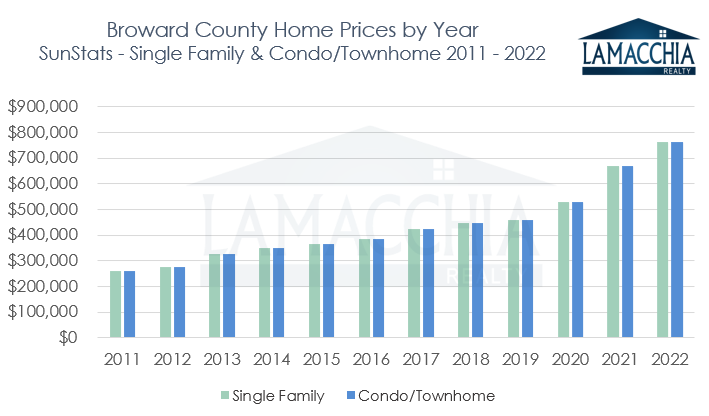

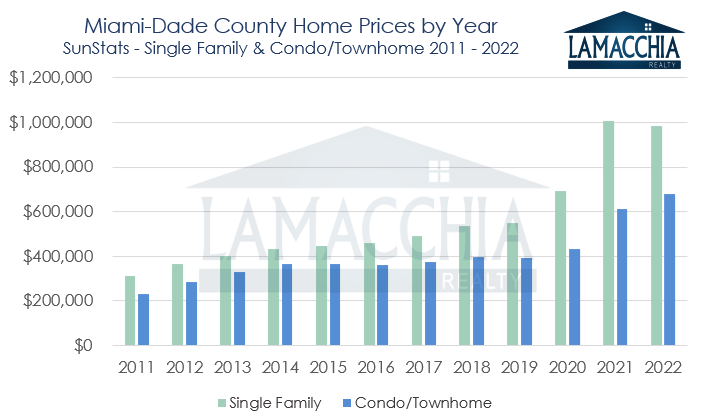

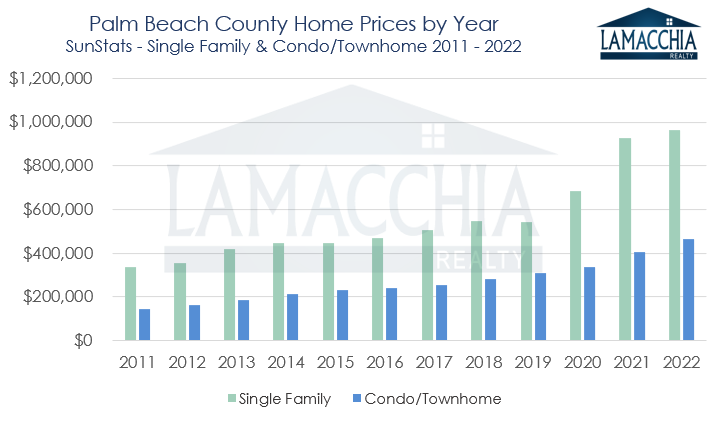

The three graphs below show average prices by year for Broward, Miami Dade and Palm Beach Counties by category:

Overall average prices for the year in Broward were up 15%. If you were to break condos and single families apart you would see that:

Single Family prices were up by 14% from $668,533 in 2021 to $763,768 in 2022.

Condo prices were up by 21% with prices rising to $358,647 from $296,632.

Overall average prices for the year in Miami Dade increased by 3% with single families actually dropping by 2% from $1,007,595 to $986,464 and condos rising 11% from $612,855 to $677,545.

Palm Beach County overall prices were up 7% with single families rising 4% and condo/townhomes rising 14%. Single family prices rose to $964,179 from $926,303 and condo/townhome prices came in at $465,773 from $407,697.

Prices for all these three counties combined were 7.5% higher than they were in 2021. 2022 was a strong market despite the climate disaster in the fall, rates, and the thickening plot with obtaining home insurance in Florida, which has become more costly to obtain complete coverage.

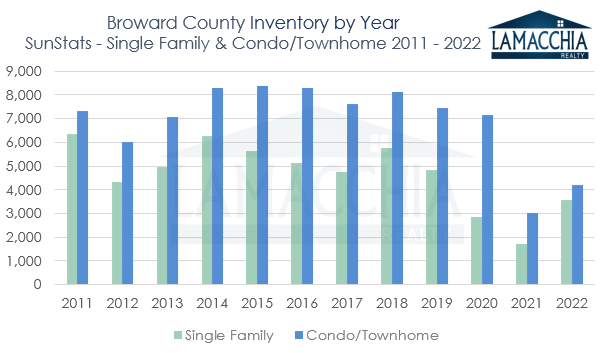

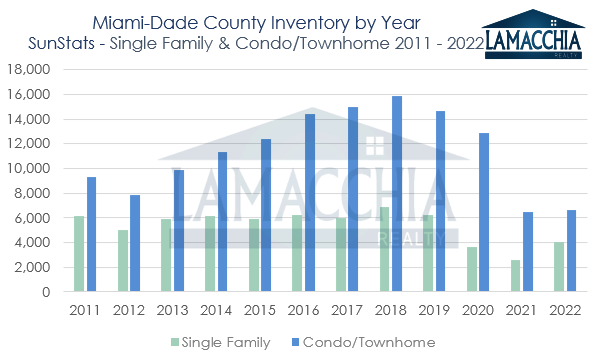

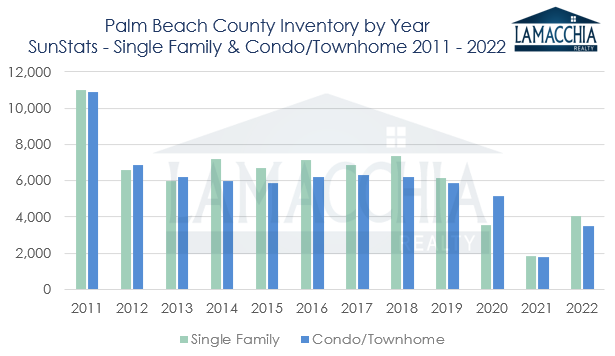

Inventory of Homes for Sale

The six graphs below illustrate the inventory of homes for sale for all three counties broken down by Single families and Condos/Townhomes by month for the entire year. 2021 was significantly lower than previous years in all three counties and 2022 certainly crept back up to more typical levels. Condo inventory is predicted to spike in 2023 due to multiple factors such as the new regulations and higher HOA fees as a result, so if sellers are thinking of selling their condo/townhome, NOW is the time to do it before everyone else gets the same idea.

South Florida inventory wasn’t able to reinvigorate itself in 2022 as the still voracious buyers that didn’t find what they wanted in 2021 consumed available inventory. Then, as rates rose, buyers and sellers began to hesitate to play the game. Sellers hesitated to list because they didn’t want to lose their low mortgage rate and buyers struggled with increased monthly payments due to rising pricing and borrowing costs.

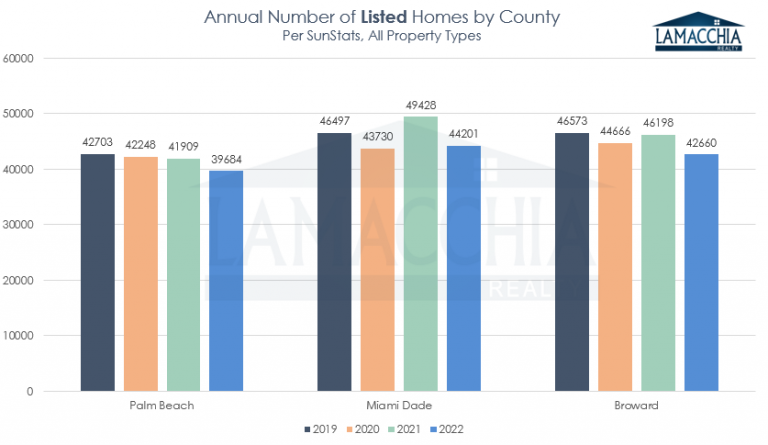

Homes Listed for Sale

Overall homes listed for sale for all property types for all three counties was down 8% from 2021 for reasons listed above including rates, seasonality, and climate.

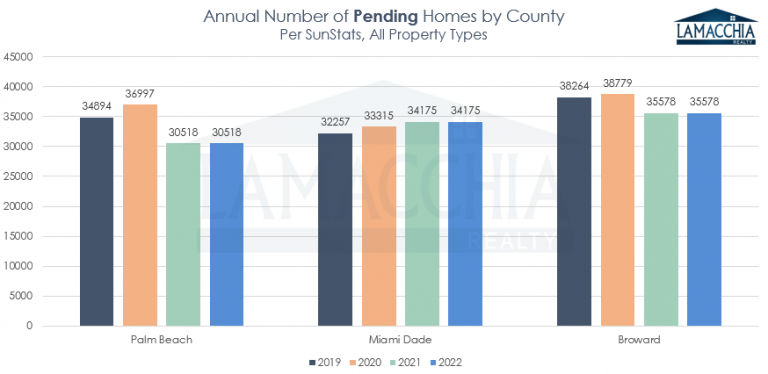

Pending sales overall for the three counties were down 25.8% over 2021. Again, when you compare the hyper-frenzied market of 2021 to 2022 it’s natural, expected, and frankly welcome that the market cooled down this year. It’s the necessary adjustment that is necessary to level out the playing field for buyers and sellers. Offers weren’t made as much, buyers cooled down mostly because the lot of them found what they needed in 2021, and those that weren’t fully committed put buying on the back burner when rates started to rise. The diminished pending sales are what helps inventory rise, and that added supply is what will help balance out demand and theoretically help prices stop rising at unsustainable rates. Anthony clearly explains this in his 2023 predictions.

2022 and Beyond

What’s happening in the South Florida market is happening in a similar fashion nationally. Warmer states don’t have the seasonality that the northern states have in terms of winter versus summer, but the climate does play a hand during hurricane season. There’s also tourism and popular times when snowbirds tend to make their purchases. Other factors especially recently have to do with the insurance changes happening as well as the relatively new condo requirements due to the horrific Surfside collapse in 2021.

Home insurance is experiencing its own adjustment period as most national insurance providers have skipped out of the state unable to contend with the climate risk. The lack of options for the consumer is making it more and more expensive to obtain coverage which in turn makes it hard to buy a property with peace of mind. Policymakers are making adjustments to attract more vendors to come back to Florida but to do so the consumer may have to jump through more hoops.

After the Champlain Tower collapse in Surfside, Florida, stricter condo regulations have been put in place to mandate more frequent condo inspections. All in all, this is a necessary change to ensure that history doesn’t repeat itself, but it’s making HOA fees astronomically high, and they’re being raised all over the place so they can cover the costs of the new assessments. These higher fees are already jeopardizing affordability for buyers and current homeowners and this overtime is likely to cause condo values to drop even more. As mentioned earlier in the inventory section of this report, these factors are going to cause condo inventory likely to spike, so if selling is on your radar, get serious sooner before everyone else does and competition is driven down with all the saturated supply.

Affordability has been the topic of conversation all year with talks of inflation, rising rates, and prices, but as rates settle into their new normal, and prices fall a bit more that will be something that consumers are more comfortable with once again. Adjustment years are a cyclical part of the market and can be tricky. In the meantime, buying options such as mortgage assumptions and buydowns are going to be helpful to get buyers into the homes they want with a payment they can afford.

In the end, the benefits to homeownership always overcome the challenges of getting to the closing table, and turning that key for the first time makes it all worth it. The asset growth, the building of equity, fixed payment, and tax benefits, along with the fact that you control your own domain are key reasons homeowners rarely regret making that offer. After all, who wants to pay someone else’s mortgage?