February 2023

south florida housing report

February Highlights

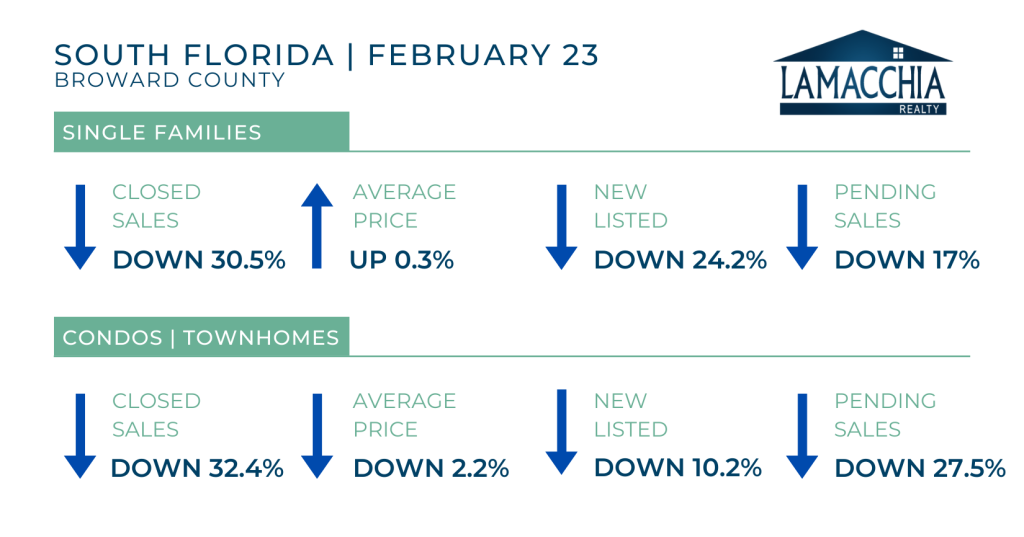

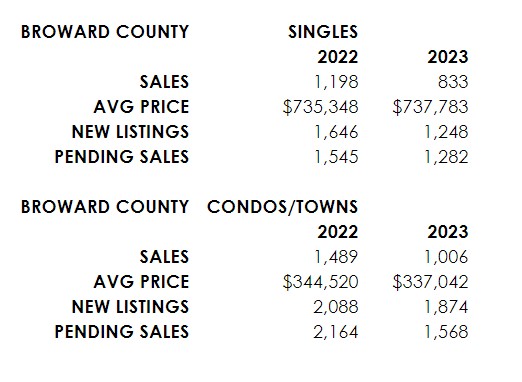

- Single family homes sales are significantly down again in Broward, Miami-Dade and Palm Beach counties in February compared to this time last year. New listings and pending sales are also down year over year as many sellers are hesitating to put their homes on the market, so less homes are being placed under contract and inevitably less homes are closing.

- Home sales are also down significantly for condos and townhome in all three counties, but unlike single family homes, there are more condos/townhomes being listed than pending. The significant decrease in pendings is an indicator of diminished buyer demand for these property types, and clearly, it is much lower than what we are seeing for single-family homes.

- Condos were an attractive option during the frenzied pandemic housing market when single-family inventory was depleted, but now demand has been negatively impacted by several new pieces of legislation as well as increased expenses for condo owners resulting from the Surfside Collapse in 2021. We are already seeing non-owner occupied condo listings increase as owners want to offload their units rather than deal with the new changes and fees in the condo market such as expensive property insurance, and increased HOA fees to cover new building safety requirements and maintenance.

- The market for 2nd home sales and investment properties should also be taken into consideration given its prevalence in Florida, but with wealth and disposable income down compared to two years ago, we may see sales numbers impacted even further in South Florida as less consumers are able to make these types of purchases.

- Sellers, the sooner you put your home on the market, the more it will sell for! Most sellers are hesitating to list because they have a low, pandemic era mortgage rate. However, there are serious buyers in the market looking to purchase a home, even more so in Florida as the market is still attractive to out-of-state buyers. There isn’t enough supply to meet the demand in the market, but listings are expected to increase as the year rolls on, so selling your home now gives you an advantage!

- Mortgage rates climbed to the high 6s in the month of February and jumped up past 7% in early March. Crisis in the banking sector exemplifies greater macro-economic issues that the FED is working to combat, but in the end, when bad things happen in the economy, good things happen with mortgage rates. This explains why rates have already fallen and we expect the trend to continue in the coming weeks. Rates will continue to be volatile, keeping both buyers and sellers on their toes though the spring months.

- Buyers, falling mortgage rates is good news! This increases your affordability and soon when there are more listings on the market, your options will increase, and the level of competition currently in the market will lessen. Be informed and prepared during this time. Have updated preapprovals, understand comps in your local market, and know your mortgage options!

- During the pandemic, Florida saw massive spikes in average home prices as demand for homes in a warm, sunny state skyrocketed in the ‘work from home’ era, but supply could not keep up with this new demand. Now, as the market has cooled down, we have seen average prices in South Florida slow their increase and even begin to decline, exemplified by the February average price data which shows a slowing or a complete turnaround of price appreciation across all three counties. This trend is expected to continue as the year progresses.

SOUTH FLORIDA

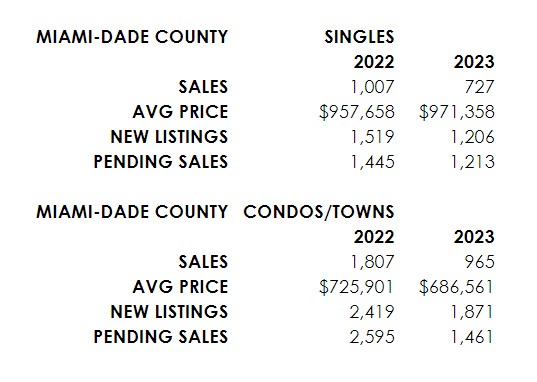

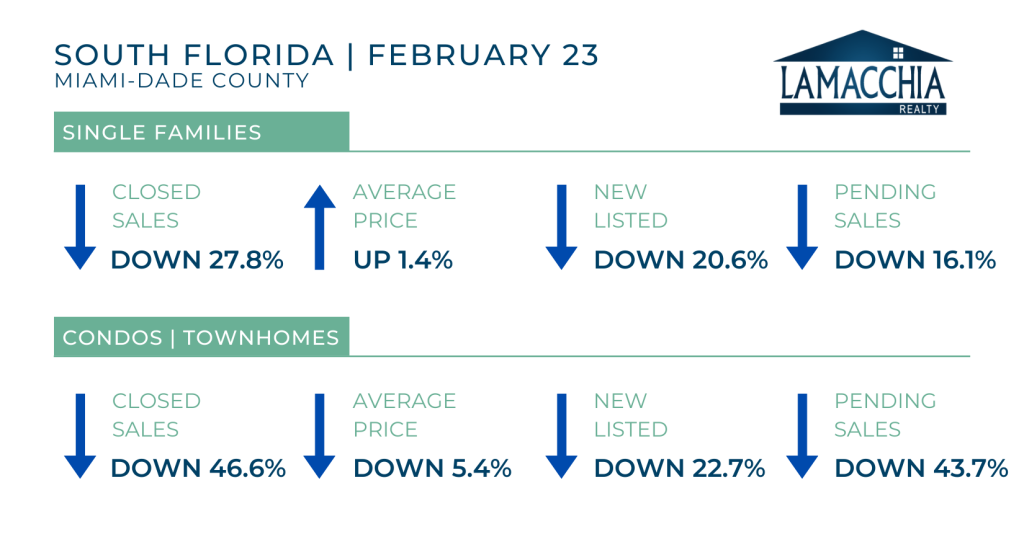

Miami-Dade County

In February of 2023, Miami-Dade single-family and condo/townhome closed sales, new listings, and pending sales decreased. The average price slightly increased for single-family homes and decreased for condos and townhomes.

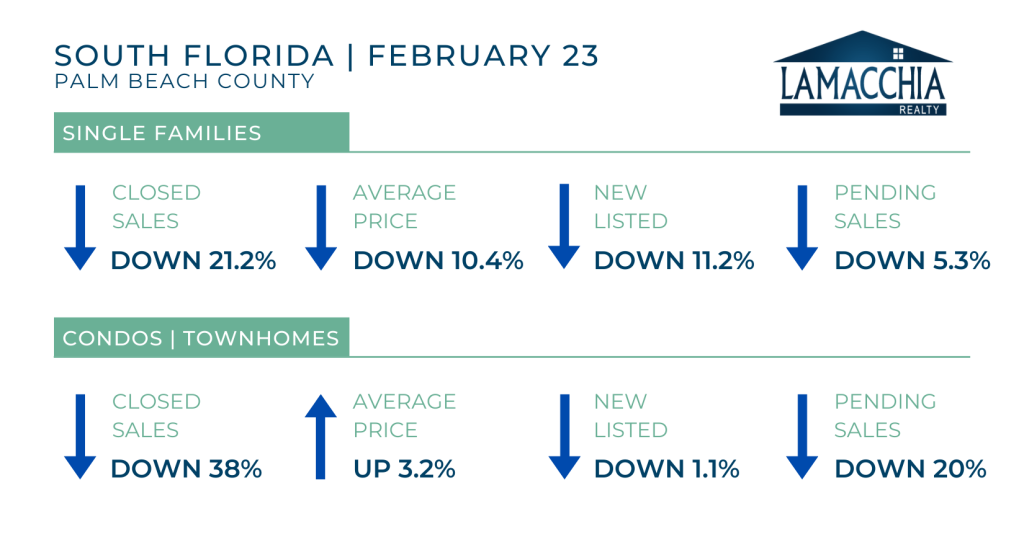

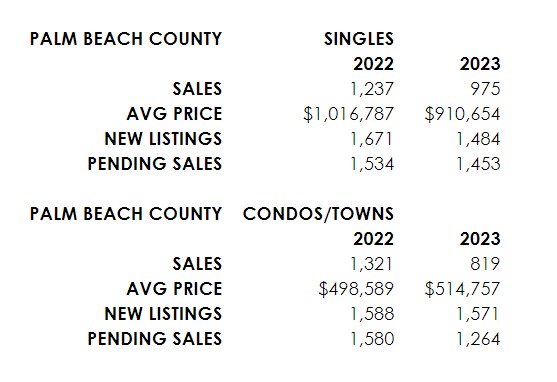

Palm Beach County

In February of 2023, Palm Beach single-family and condo/townhome closed sales, new listings, and pending sales decreased. The average price increased for condos and townhomes and decreased for single-family homes.