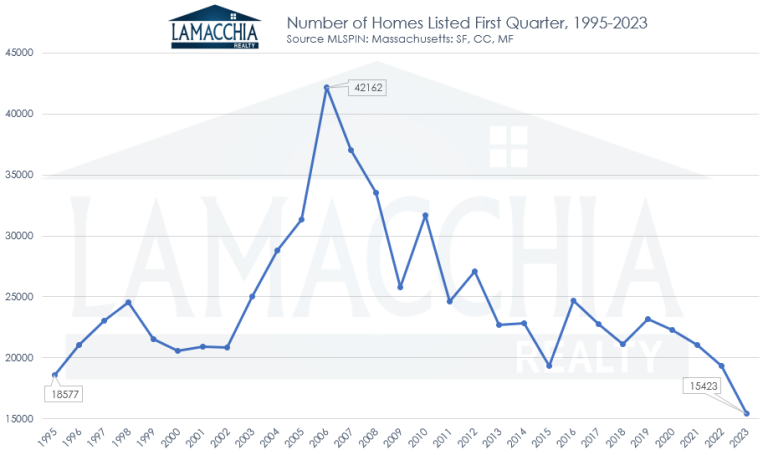

Those following the real estate market have been witnessing historic behavior in real-time since the onset of the Pandemic in March 2020. The first quarter of 2023 was no exception. This week we ran a “Homes Listed” Report in MLSPIN which is the Multiple Listing Service in Massachusetts and what we suspected was true. There has never been a first quarter of the year (January, February, March) since at least 1995 that fewer homes have been listed for sale than this year. MLS started in 1999 but has data for the most part back to 1995. We have no way to go back further but we suspect that this is the slowest start to the year for homes listed since 1982. Below is a chart that goes back to 1995 which shows the number of homes listed for sale in every 1st quarter since. You’ll see that 2023 was the slowest first quarter for the number of homes listed in recorded history. There were 15,423 listings in Q1 of 2023, the closest year was back in 1995 with over 18,000 homes listed.

Anthony talked a lot about the current market’s similarities to the early 80s in his 2023 Predictions blog that was released in late December. Unfortunately, it appears that his predictions will be mostly right with the only exception being that sales in 2023 may end up being lower than previously predicted.

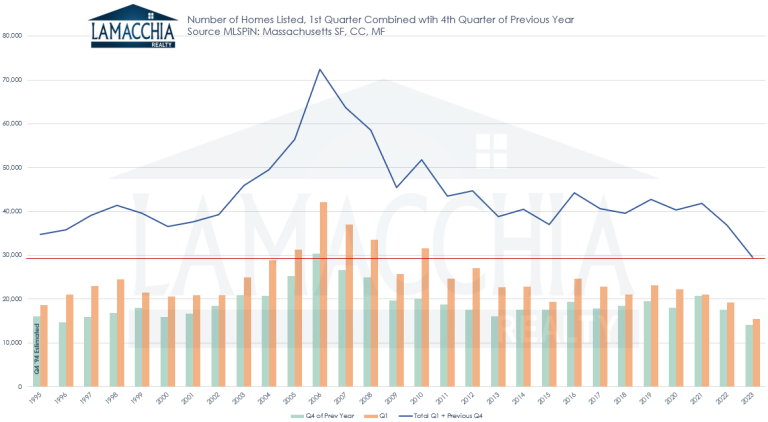

To further solidify the point, Q4 of 2022 exhibited the lowest number of homes listed out of any previous Q4 since records were kept. The bar chart below depicts the number of homes listed in the first quarter of every year (orange) and the fourth quarter of the previous year (mint). The blue line is the total number of homes listed when you add those two numbers together. 2023 has exhibited the least number of homes listed over a 6-month period (two consecutive quarters) of any 6-month period since records have been kept starting in 1995 (red line). This sure explains why every Realtor feels like business is so slow.

WHY?

It’s NOT for a lack of buyers. There are ten times more buyers in the market than sellers despite the higher mortgage interest rates. Bidding wars are happening everywhere on just about every home that is priced right. Buyers this spring are once again very frustrated and there doesn’t appear to be any end in sight. Although it will ease as we get closer to summer until fall, as the fall market tends to slow back down.

Why are so few homeowners listing? Does no one WANT To sell?

Most homeowners are in a holding pattern and even though they would like to move and have hopes to list their home to upgrade, downsize, or relocate, the sellers with pandemic-era rates in the 2’s and 3’s can’t justify selling and trading in those low rates for the current mortgage rates that are in the 6’s or 7’s. On Wednesday, April 5th we did experience a drop in rates, which had a brief, positive effect on the market but they have gone back up a half point since then and as of April 10th were an average of 6.5%. The longer that rates stay lower, the more sellers will list so they can take advantage of the higher affordability they’ve been waiting for when they turn around to buy.

Most homeowners are in a holding pattern and even though they would like to move and have hopes to list their home to upgrade, downsize, or relocate, the sellers with pandemic-era rates in the 2’s and 3’s can’t justify selling and trading in those low rates for the current mortgage rates that are in the 6’s or 7’s. On Wednesday, April 5th we did experience a drop in rates, which had a brief, positive effect on the market but they have gone back up a half point since then and as of April 10th were an average of 6.5%. The longer that rates stay lower, the more sellers will list so they can take advantage of the higher affordability they’ve been waiting for when they turn around to buy.

We saw a similar delayed market phenomenon happen in 2015, where a lot of sellers delayed listing (not as many as this year) until the 2nd quarter because of all the snow in the winter of Snowmageddon when so many sellers waited to list until conditions improved from all the snowstorms.

High rates have clearly been culpable for historically low listings, but prices, which skyrocketed during the pandemic, are also responsible as buyer affordability is at an all-time low. Couple that with inflation, and consumer sentiment has kept sellers (many of which are also buyers) sitting on their hands. The outcome is exactly what we are seeing now: fewer sellers, frustrated buyers, and a delayed real estate market that is in the midst of a turbulent, but finite, adjustment period following a global pandemic. It’s as Anthony predicted, “As markets do in all phases of economics, we are going to see a classic over-correction due to a lack of buyers as well as a lack of sellers who are holding off selling.” What we aren’t seeing now is a “crash” in prices as many fearful consumers may think. A crash, typically referred to as high inventory and plummeting home prices, is the exact opposite of what we are seeing now.

Though we aren’t likely to ever see pandemic-era rates again, buyers and sellers should always keep an eye on rates to take advantage of times when they drop a bit. Buyers should have their preapprovals updated immediately, and sellers who are also buyers should have their homes basically ready to go on the market when they want to leverage buyer motivation to make offers when lowered rates are boosting their affordability. More sellers who are also buyers should be taking advantage of mortgage rate buy-downs and even looking into mortgage assumptions. Instead of connecting with a Realtor and looking into various options such as the two I mentioned and properly preparing most want-to-be sellers are just sitting on their hands right now and not doing anything.