march 2023

south florida housing report

March Highlights

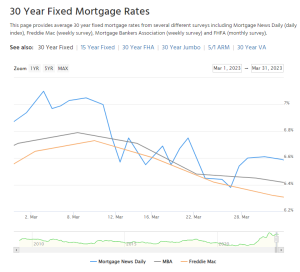

- Mortgage rates jumped up past 7% in early March

but fell back down as the month continued. Inflation, monetary policy, and other economic factors have already impacted the mortgage rate landscape and will continue doing so as the year goes on. Specifically, the ongoing bank crisis, affecting prominent financial institutions such as Silicon Valley Bank, has created upheaval in the stock market, further intensifying financial fear and uncertainty among consumers. Both buyers and sellers pulled back from the market as a result. The situation could impact South Florida even more given its market for 2nd homes and investment properties as consumers become more cautious with their disposable income.

but fell back down as the month continued. Inflation, monetary policy, and other economic factors have already impacted the mortgage rate landscape and will continue doing so as the year goes on. Specifically, the ongoing bank crisis, affecting prominent financial institutions such as Silicon Valley Bank, has created upheaval in the stock market, further intensifying financial fear and uncertainty among consumers. Both buyers and sellers pulled back from the market as a result. The situation could impact South Florida even more given its market for 2nd homes and investment properties as consumers become more cautious with their disposable income. - Buyers, be prepared to take advantage of periods of lowered interest rates as your affordability is increased during these times! Have updated preapprovals at the ready and be informed of all your mortgage options to make sure you can find success in this market!

- Single-family home sales in Broward, Miami-Dade, and Palm Beach counties were down again in March 2023 compared to this time last year, but the difference was not nearly as significant as it was in February 2023. New listings and pendings are trending up for the year as more and more sellers list their homes giving buyers more to choose from, but both still fall below 2022 levels.

- Sellers, stop hesitating and list your home NOW to make the most money! There are serious buyers in the market, especially during periods of rate drops, but inventory still hasn’t risen enough to meet the demand in the market. More listings (supply) are already coming on the market, and buyer demand will lessen as homes are purchased, leases renewed, etc., so don’t miss this period of opportunity!

- The condo/townhome market is slower to improve when compared to the single-family market with sales down significantly across all three counties for the month. Additionally, similar to the data we saw last month, there were more condos/townhomes listed than pending in March 2023 indicating buyer demand for the property type is still diminished.

- Interestingly, condos were a popular alternative when the inventory for single-family homes ran dry during the pandemic-induced frenzied housing market. However, new legislation and increased expenses for condo owners following the Surfside Collapse in 2021 have negatively impacted the demand for condos. Accordingly, owner-occupied condo listings are now up as owners are opting to sell rather than deal with the new changes and fees, such as costly property insurance and higher HOA fees to cover new building safety requirements and maintenance.

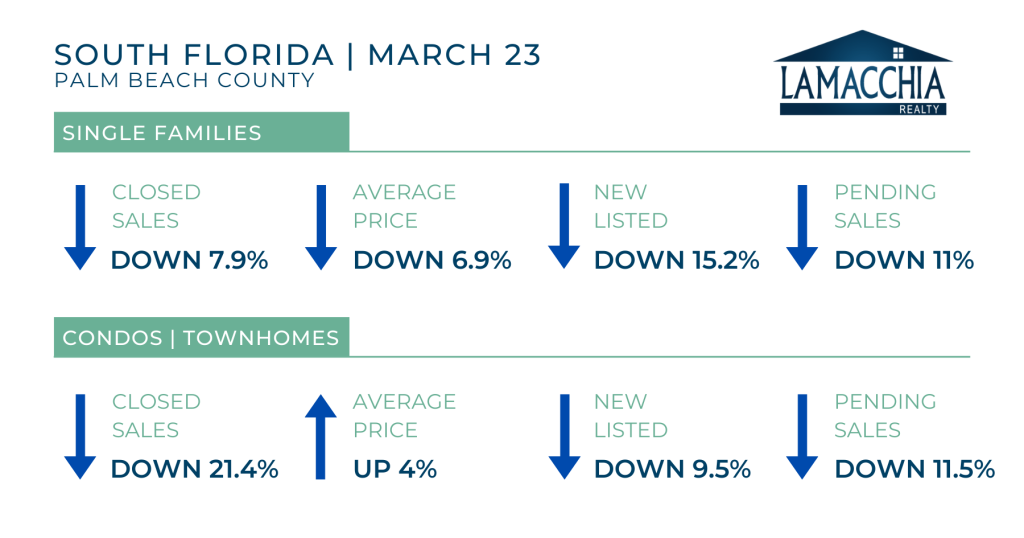

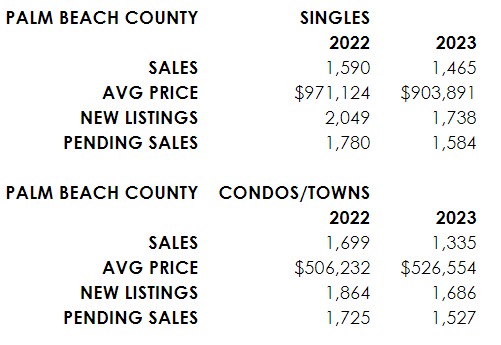

- Average sales price is down year over year for single families and condos/townhomes in all counties except for Palm Beach County condos/townhomes, where price increased, but only by 4%. The turnaround and/or slowing in price appreciation should continue as more homes get put on the market. Increasing supply will help also help with availability and affordability for buyers as well. In fact, Governor DeSantis recently signed Florida’s new, comprehensive, affordable housing law, the “Live Local Act,” which puts over $700 million into housing with the intention of creating more affordable housing in the state.

SOUTH FLORIDA

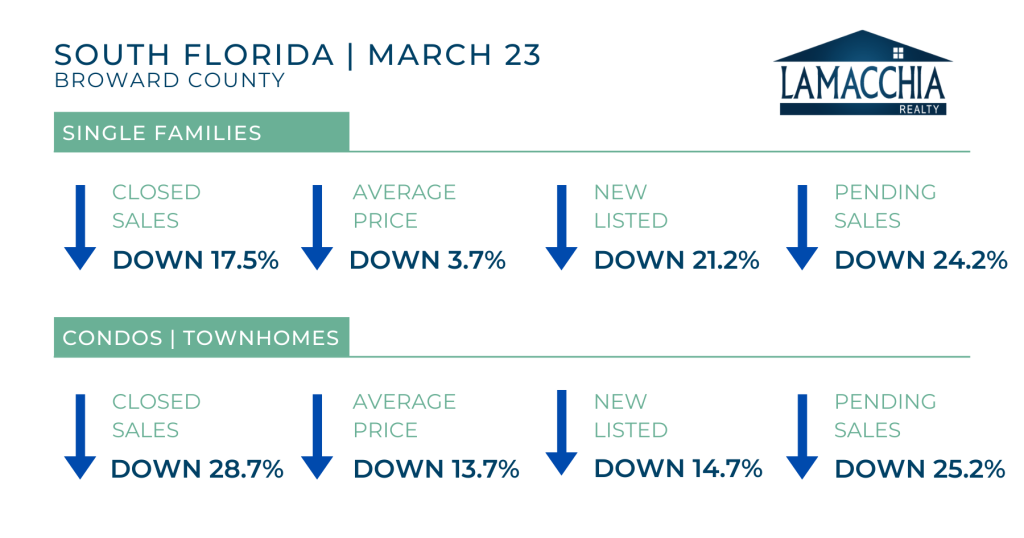

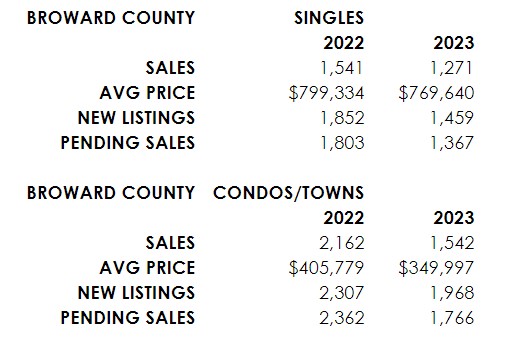

Broward County

In March of 2023, Broward County single-family and condo/townhome average price, closed sales, new listings, and pending sales all decreased.

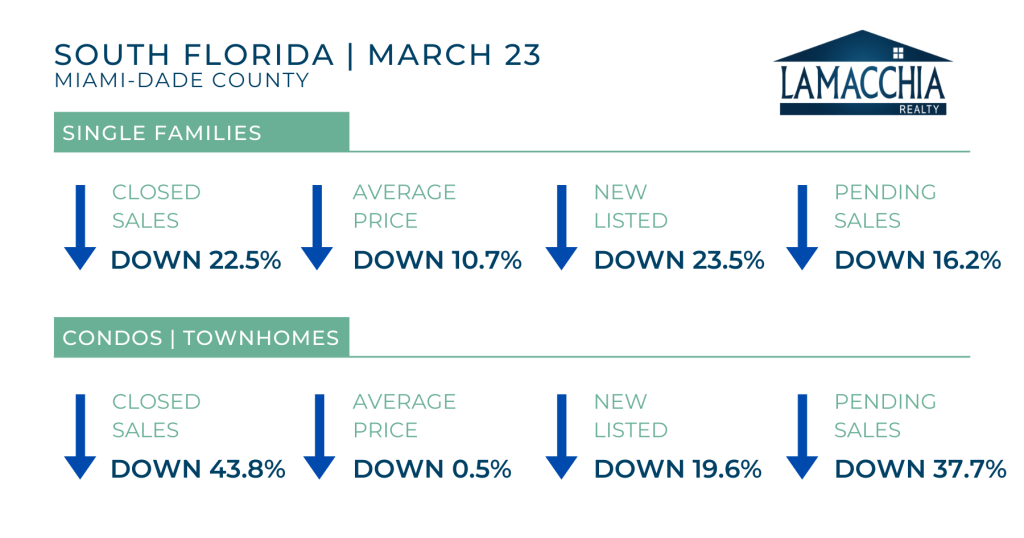

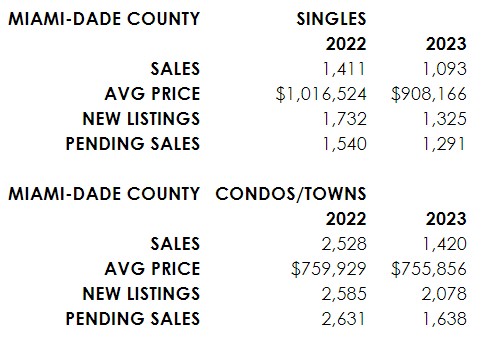

Miami-Dade County

In March of 2023, Miami-Dade single-family and condo/townhome closed sales, average price, new listings, and pending sales all decreased.

Palm Beach County

In March of 2023, Palm Beach single-family and condo/townhome closed sales, new listings, and pending sales decreased. The average price increased for condos and townhomes and decreased for single-family homes.

Data provided by SunStats then compared to the prior year.