April 2023

massachusetts housing report

April Highlights

- Buyers and sellers are still contending with rates as the average lender is now at their highest levels since early March. They’re hovering in the high 6 to 7% range for a 30-year fixed.

- The worst is over for this year’s market for buyers! More listings will come on, many other buyers have either resigned their leases or have accepted offers and competition is down! Take advantage of the market- watch Anthony’s video explaining the good news.

- Buyers have to stay on their toes and be ready to strike with an adjusted pre-approval as soon as rates make unexpected but desirable moves down to maximize their affordability.

- Sellers are in a stalemate with the market as many desire to make a move but hesitate knowing they’d be trading in their pandemic-era rate for a higher one. Though selling now with listings down will get you the most money for you home!

- Buyers and sellers should keep in mind that there are several mortgage options available to help navigate current rate climate such as buydowns and mortgage assumptions.

- Home sales are down considerably compared to the past few years which is to be expected given that they were at such elevated, frenzied levels during the pandemic. This is the unavoidable nature of a market adjustment.

-

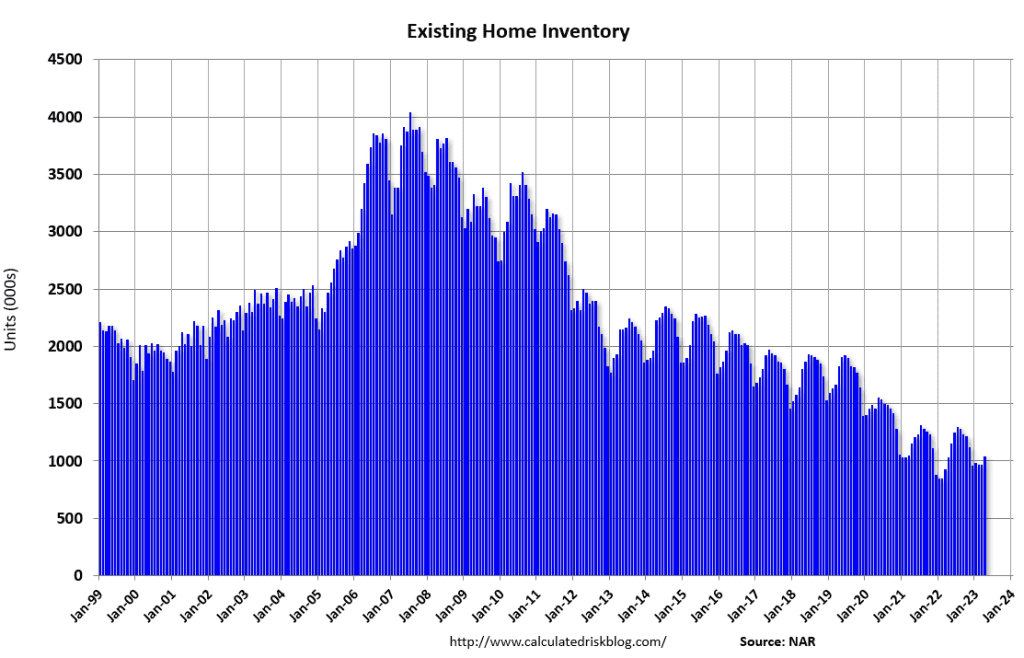

No, Prices are NOT crashing. In fact, a crash is caused by excess inventory and low demand, which causes prices to drop. The opposite is the case as inventory is incredibly low. So, buyers waiting for that to happen are just letting homes pass them by, and sellers should get out there now to sell and get a great offer on their homes.

- The average price overall is up in April over last year. Currently, demand exceeds supply keeping inventory low and inherently supports prices and prevents them from falling.

- Categorically, condos and multifamily prices are down slightly which many would say is a good thing, given that the astronomical price hikes during the pandemic were making homebuying prohibitive and this is the adjustment we have all been waiting for. Lowered prices are also helpful given that rates make buying more expensive.

- Homes are in fact selling, and as mentioned above, would-be sellers just aren’t listing enough to keep up, as indicated by Q1 being the lowest number of homes listed in recorded history.

- The spring/summer market typically heats up with more activity, so anyone interested in making a move should consider getting prepared to do so. Sellers like to sell when it’s nice out and buyers with families tend to want to close on their homes with enough time to get settled before the new school year.

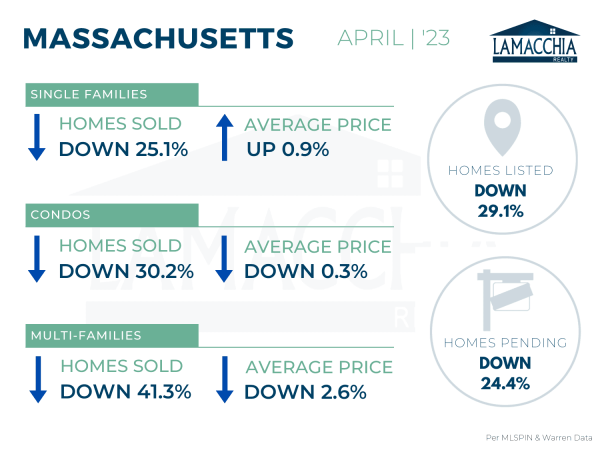

MASSACHUSETTS

Combined Home Sales Down 28.4%

Combined sales are down 28.4% year over year, with April 2023 at 4,779 compared to 6,670 last April. Sales are down across all categories.

- Single families: 3,870 (2022) | 2,897 (2023)

- Condominiums: 2,149 (2022) | 1,500 (2023)

- Multi-families: 651 (2022) | 382 (2023)

Combined average prices have continued their rise with another year-over-year increase of 0.5%, now at $679,964.

- Single families: $697,882 (2022) | $704,187 (2023)

- Condominiums: $653,088 (2022) | $651,446 (2023)

- Multi-families: $624,543 (2022) | $608,239 (2023)

Homes Listed For Sale:

The number of homes listed is down by 29.1% when compared to April 2022, as would-be sellers are concerned about jumping into the market.

- 2023: 6,620

- 2022: 9,338

- 2021: 10,833

Pending Home Sales:

The number of homes placed under contract is down by 24.4% when compared to April 2022.

- 2023: 6,178

- 2022: 8,170

- 2021: 9,335

Price Reductions:

The number of price reductions is down 41.5% when compared to April 2022. Sellers, pricing your home right is crucial in this market.

-

- 2023: 264

- 2022: 451

- 2021: 553

Data provided by Warren Group & MLSPIN then compared to the prior year.