april 2023

new hampshire housing report

April Highlights

- Buyers and sellers are currently grappling with mortgage rates that have reached their highest levels since early March. The average lender is now offering rates in the 6 to 7% range for a 30-year fixed mortgage, posing an affordability challenge for those in the market.

- Buyers, the worst is over for this year’s market! With more options available as other buyers exit the market and more sellers list, you may have a greater opportunity to find the perfect home and potentially negotiate better terms.

- Buyers should remain vigilant and prepared to be ready to strike with an updated pre-approval if mortgage rates unexpectedly drop, allowing them to boost affordability.

- Many sellers find themselves at a standstill in the market, torn between their desire to make a move and the hesitation that stems from trading their pandemic-era interest rate for a higher one. Sellers would be well advised to sell now to take advantage of the buyer demand and low inventory, which ensure their home sells for the most money!

- Buyers and sellers should take advantage of the various mortgage options available to navigate the current rate climate, such as buydowns and mortgage assumptions.

- Home sales have declined compared to the past few years, which is expected considering the elevated and frenzied levels they reached during the pandemic. This adjustment is a natural part of the market trying to level itself out.

-

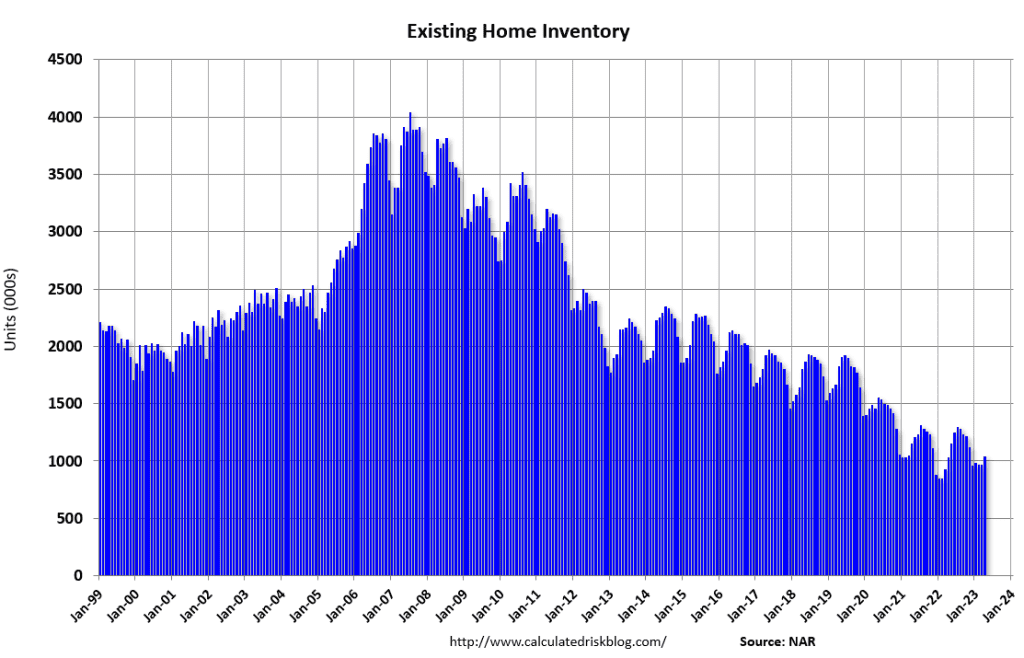

Let’s be clear: prices are NOT crashing. A market crash typically occurs when there is an oversupply of inventory that surpasses the demand, leading to a decline in prices. However, the current situation is the opposite, with inventory levels being extremely low. Buyers, take heed, waiting to make offers on homes because you’re hoping the prices will drop will cause you to wait longer than you want. Sellers should get out there and list, there’s no time like the present!

- This imbalance, where demand exceeds supply, has resulted in an overall increase in average prices in April compared to the previous year. The limited inventory acts as a support for prices, preventing them from falling.

- Homes are indeed selling, but there’s a shortage of listings and therefore pending sales are decreasing as a result.

- The spring/summer market typically sees increased activity, so those interested in making a move should consider getting prepared. Sellers often sell when the weather is nice, and buyers with families often aim to close on their homes before the new school year to allow time to get settled.

NEW HAMPSHIRE

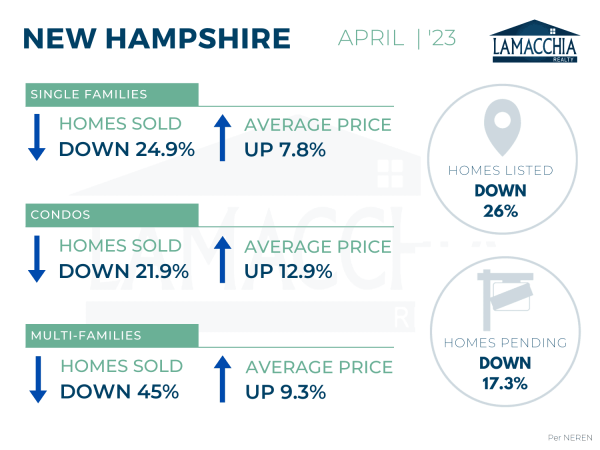

Combined Home Sales Down 25.7%

Combined sales are down 25.7% year over year, with April 2023 at 1,050 compared to 1,414 last April. Sales are down across all categories.

- Single families: 952 (2022) | 715 (2023)

- Condominiums: 351 (2022) | 274 (2023)

- Multi-families: 111 (2022) | 61 (2023)

The combined average price increased by 8.9% when compared to last April, now at $516,224. Prices increased in all categories.

- Single families: $515,307 (2022) | $555,342 (2023)

- Condominiums: $377,113 (2022) | $425,827 (2023)

- Multi-families: $424,110 (2022) | $463,758 (2023)

Homes Listed For Sale:

The number of homes listed is down by 26% when compared to April 2022 as would-be sellers are concerned about jumping into the market.

- 2023: 1,666

- 2022: 2,250

- 2021: 2,544

Pending Home Sales:

The number of homes placed under contract is down by 17.3% when compared to April 2022.

- 2023: 1,614

- 2022: 1,951

- 2021: 2,236

Data provided by NEREN then compared to the prior year.