May 2023

connecticut housing report

May Highlights

- Connecticut single family and condo/townhome sales are significantly lower once again this month when compared to May 2022. This is the number of homes sold NOT home prices. However, we expect the housing market to pick up during the upcoming summer months as more sellers prefer to list when it is nicer outside, and buyers are eager to close to prepare for the school year and colder months.

- Mortgage rates continued to be volatile in May, starting out in the mid-6%’s then climbing to over 7% by mid-May to then returning to just under 7% as the month concluded. This is around 1.5% higher than the same time last year.

- Increased rates reduced buyer affordability and took buying a home off the table for some. Rates also impacted sellers who have been ready to move but are holding on to their current homes to keep their 2-3% pandemic-era mortgage rate.

- Listings are also down year over year due to sellers hesitating to put their homes on the market. Inventory levels are fighting to recover, but still have not risen enough to compensate for the buyer demand in the market. These conditions will prevent prices from dropping significantly or even at all.

- Compared to this time last year, prices are appreciating at a slower rate. This is mainly because many of the homes that closed in May were put under contract in March and April, but mortgage rates this year were over 2% higher in March and April compared to 2022. For example, a home that sold for $400k at a 4% interest in 2022 would have a $1,910 monthly payment. Now, just a year later, that $400K home is now worth $425K and rates are 6% so their monthly payment is now higher at $2,548. The current market conditions (i.e., high demand, low supply) would typically lead to an increase in prices, but the difference this year is that factors such as increased mortgage rates and inflation are straining overall consumer affordability which will keep housing prices from skyrocketing.

- There are still plenty of serious buyers in the market despite rates impacting home affordability, and many buyers will be looking to get off the sidelines in the coming months. Remember, there is a cost to waiting to get into the market. Buyers need to stay prepared and informed so that they are ready to strike in this summer market!

- As we head into the latter half of the year, there is good news and bad news for sellers. Typically, the beginning of the year is the best time to list, however, many sellers are also buyers, and this half of the year is a great time to buy! To be successful in this market, you must price your home competitively. The more buyers you can attract, the more leverage you have and that gives you the ability to better dictate terms!

CONNECTICUT

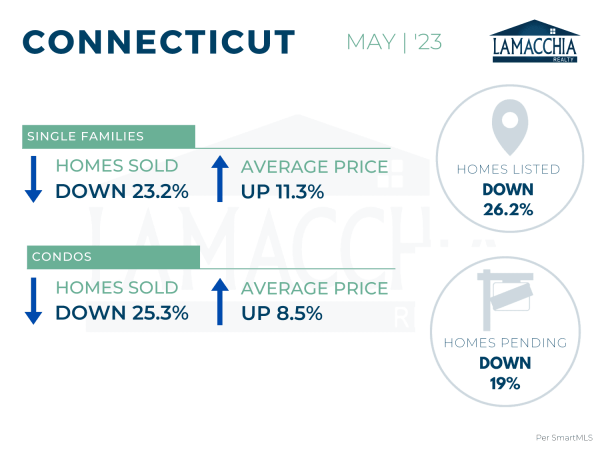

Combined Home Sales Down 23.7%

Combined sales are down 23.7% year over year, with May 2023 at 2,936 compared to 3,848 last May. Sales are down across all categories.

- Single families: 2,958 (2022) | 2,271 (2023)

- Condominiums: 890 (2022) | 665 (2023)

Combined average prices have increased by 11.1% compared to last year, now at $530,731 from $477,546.

- Single families: $535,219 (2022) | $595,464 (2023)

- Condominiums: $285,671 (2022) | $309,862 (2023)

Homes Listed For Sale:

The number of homes listed is down by 26.2% when compared to May 2022, as would-be sellers are concerned about jumping into the market.

- 2023: 4,272

- 2022: 5,792

- 2021: 6,634

Pending Home Sales:

The number of homes placed under contract is down by 19% when compared to May 2022.

- 2023: 3,452

- 2022: 4,263

- 2021: 5,090

Data provided by SmartMLS then compared to the prior year.