As predicted, 2024 has started with low inventory, and mortgage rates have remained relatively stable in the high 6’s and low 7’s. Due to rising rates and home prices that have continued to influence consumer spending, 2023 saw the lowest inventory in recorded history, and in 2024, sellers are still hesitant to enter the market. Although inventory is slightly higher now than this time last year, competition is still fierce. Those looking to buy a home this year need to do all they can to make the strongest offer when the right house becomes available. The first line of defense is hiring a REALTOR® who is experienced in handling the complexities of multiple offers in this adjusting market with higher rates. With an expert in their corner, buyers will have a highly skilled professional to help them implement some of the following tactics to help set their offer apart from others in a bidding war.

Pre-Approval Letter or Pre-Commitment

Have your lender keep your pre-approval letter or pre-commitment current (within 20 days of rates making any sort of significant move), and if possible, specific to the property you’re bidding on. When choosing your lender, make sure they are committed and ready to go up to bat for you in a bidding war. They should be well known, respected among agents in the area, and highly specialized in mortgage lending. If this lender is really willing to advocate for you, they’ll get on the phone with the listing broker, after hours if required, and vouch for you; that you’re fully qualified for the loan and that your documents have been reviewed entirely.

Have your lender keep your pre-approval letter or pre-commitment current (within 20 days of rates making any sort of significant move), and if possible, specific to the property you’re bidding on. When choosing your lender, make sure they are committed and ready to go up to bat for you in a bidding war. They should be well known, respected among agents in the area, and highly specialized in mortgage lending. If this lender is really willing to advocate for you, they’ll get on the phone with the listing broker, after hours if required, and vouch for you; that you’re fully qualified for the loan and that your documents have been reviewed entirely.

Consider writing into the offer that you’ll purchase the property regardless of the appraised value. List prices typically reflect the comps (comparative properties) of homes sold in the neighborhood in the past six months. This is different from the appraised value which, as prices rise, can be lower than the list price. Lenders lend based on the appraised value or purchase price (whichever is lower), so if you offer based on the higher list price, you’re responsible for covering the difference. However, in a market where prices are increasing, you should not have any problem getting the value of what you paid.

Compose a Personal Letter

While the actual terms of an offer are ultimately most important, sellers often want to know more about why a buyer wants to purchase their home. A home is typically someone’s prized possession, and they want to know you’ll care for it as they do. Some buyers send that message with a heartfelt letter showing how much they love the home. Appeal to their emotions. As an example, if they have owned the home for a long time but it has fallen into disrepair, explain how you can’t wait to revive it and bring back its charm and beauty. Keep in mind that if you are writing a letter, be sure it does not violate any Federal or State Fair Housing Laws.

Offer Over Asking

Sellers often price their homes aggressively to incite bidding wars. When you are making an offer in a multiple-offer situation, you can assume that the home is likely going to sell over-asking price. The tricky part is figuring out how much over the listing price you should offer. What you need to do as a buyer is offer as much over as you can without overextending your budget. An additional $10K equivalates to roughly the cost of a cup of coffee per day – would you be willing to lose your perfect home over that? Let’s say you make a 25K over-asking offer on a $500K house. Though the offer may seem high, if the property value rises 4-5% a year on average, you’d be positioned to earn the value back within a few years. Real estate is a long game.

Consider looking for homes under budget to allow for wiggle room in your available funds so you can put your best foot forward. If you widen the search bracket to reflect homes $50K under your budget, you may have an easier time winning a bidding war because you’ll be able to offer much higher than the asking price. Homes selling over-asking price has become much more common over the last couple of years, especially right now.

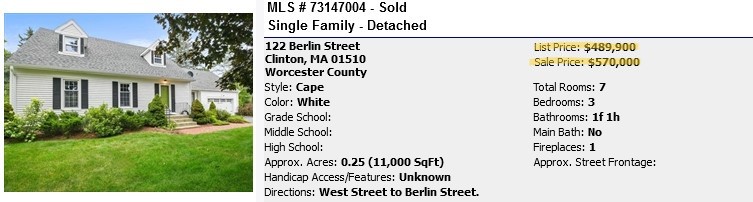

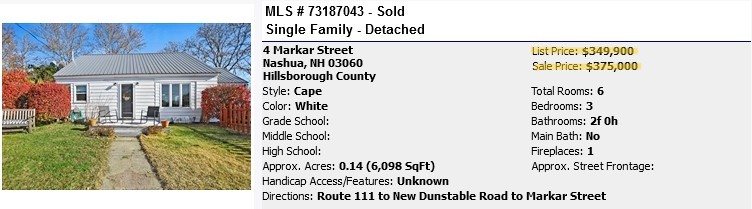

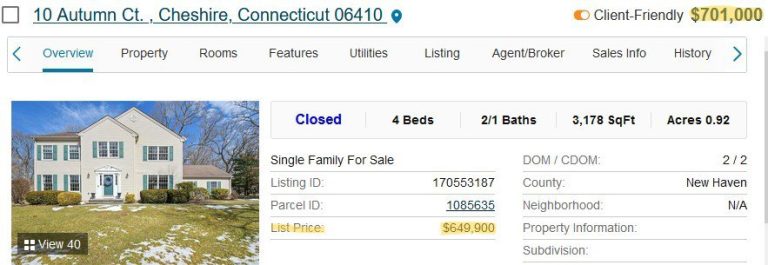

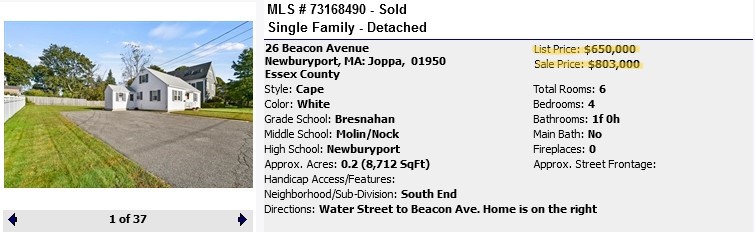

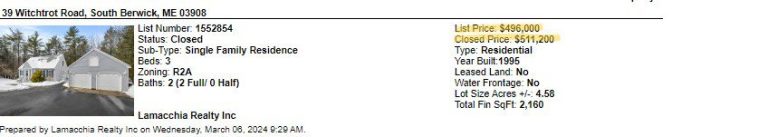

Here are a few homes that recently sold for over-asking price:

Escalation Clause

In certain circumstances, an escalation clause can be a great tool to raise your chances of beating other offers. This clause lets you offer a bit more than other buyers, up to a maximum price you set in advance, if someone else tops your initial offer. For example, let’s say you offer $505,000 on a $500,000 home with an escalation clause saying you’ll pay $5,000 more than any higher offer, but not over $520,000. If another buyer offers $508,000, your offer automatically goes up to $513,000. This way, you get to see proof of other offers and adjust yours accordingly within the limits of the escalation clause.

Consider Waiving Inspection

You can also waive the home inspection, which is the most aggressive way to show you’re serious about the property. Alternatively, you can opt for the inspection and include in your offer that you’ll cover up to a certain amount of the estimated repair cost. Buyers typically offer $5,000 – $10,000 in repair costs, but in a bidding war, these numbers may not be high enough. Be prepared to offer more if you choose to go this route. Doing so will give the seller confidence that you are fully committed to purchasing and that you won’t attempt to renegotiate or back out of the sale. Information-only inspections have been popular during these past few highly competitive years, as they give the buyer a good understanding of what potential issues they might face with a property, but it’s attractive to sellers because they know the deal isn’t dependent on the results.

Shorten Contingency Time Frames

Shorten the inspection window, purchase and sale date (if applicable by state), and mortgage contingency if possible. Speak with your lender to determine the earliest mortgage contingency date. This is attractive to a seller because if the deal falls through, the home isn’t off-market for very long. The deadlines can be flexible if necessary, as a buyer can ask for an extension. The seller will likely provide that extension within reason, as it’s likely shorter and less cumbersome than relisting the home and restarting the sale process all over again.

Increase Your Down Payment

Some sellers may feel that a buyer with a higher down payment of 10-20% is more qualified than a buyer with a 3.5-5% down payment. With this in mind, consider putting more money down if your budget comfortably allows it. Borrowing from a 401k is a viable option for some people. Although this is a loan that you’ll need to repay, you’re technically repaying yourself, and there are typically a variety of repayment options. This may be a sounder financial decision as opposed to putting less than 20% down and having to pay mortgage insurance which comes with an upfront fee and a monthly fee.

Be Flexible on Closing Date

Some sellers have inflexible circumstances and need to sell to a buyer who is willing to accommodate their time frame. Be as accommodating as possible on all fronts to make yourself stand out!

Use & Occupancy Agreement

Consider allowing a “rent back.” Some sellers need to stay in the home for a brief period after they close until they can move into their new home. This is known as a Use and Occupancy Agreement, and it can provide some benefits to the buyer as well. Buyers see the benefit of a U&O agreement if they’re in a lease they don’t want to break, or if they’re selling a home and want to close that deal before they worry about packing up and moving right away. Another benefit is that buyers can lock in an attractive rate by closing earlier, whereas closing later to accommodate the seller’s timeline could leave the buyer vulnerable to having to pay a rate lock extension.

WIN the Home of your Dreams by Working with Lamacchia Realty

The housing market has been seeing this trend for quite some time now, especially around this time of year. If you’re looking to purchase a home, take all the steps you can to find the right house for the right price, and make the right offer so that you win the bidding war. Unfortunately, it’s not always an easy process and you may not get what you want the first time. However, if you have the best group of real estate professionals behind you, you are sure to stand out to sellers and their listing agents. Doing your due diligence, hiring the right agent, and using the best lender are the keys you need to eventually beat out other offers and win the home of your dreams!